Pinewood Technologies is one of only two major suppliers of management software to UK car dealers and has grand plans to expand abroad. Maynard Paton reviews the group’s ambitious profit guidance and prospects of becoming a ‘scalable SAAS platform’.

Investment ideas can emerge from the unlikeliest of sources.

I booked my car for a service the other month and the confirmation email was sent by Pinewood DMS:

DMS stands for ‘dealer management software’ and Pinewood Technologies is one of two dominant suppliers of such systems within the UK.

A DMS allows car dealers to handle all aspects of their business — such as vehicle sales, customer enquiries, workshop appointments, parts ordering, accounts processing and marketing campaigns — within a single IT package.

Pinewood was part of car dealer Pendragon for 25 years, but for the last twelve months has operated independently and now describes itself as a “pure-play SAAS business with an accelerated growth plan“.

The growth plan centres upon sophisticated IT displacing outdated competitor systems — with US dealers in particular a lucrative target.

High levels of recurring revenue earned through a ‘scalable platform’ — alongside the prospect of bumper contract wins — have meanwhile led to very attractive profit guidance.

Let’s take a closer look.

Introducing Pinewood Technologies

Pinewood was established in 1981 and was acquired by Pendragon in 1998. The subsidiary became independent this time last year after Pendragon’s car dealerships were sold to Lithia Motors.

As part of the transaction, Lithia became a 20% Pinewood shareholder and has since increased its position to 26%:

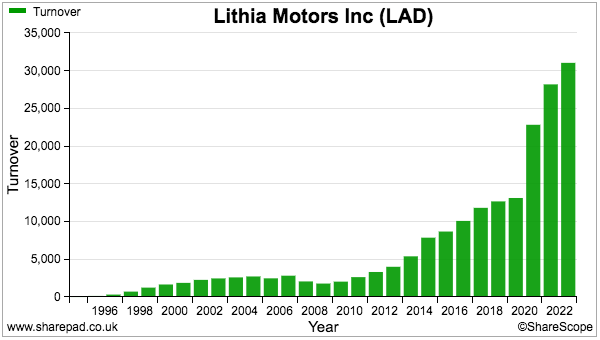

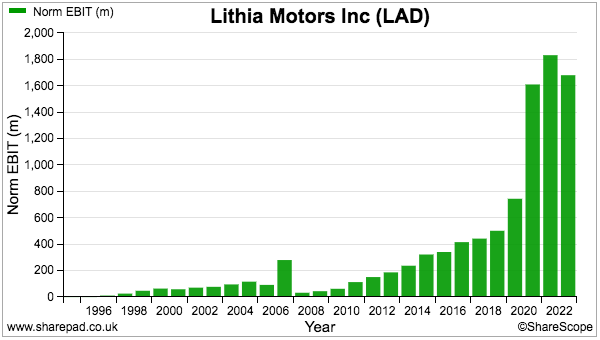

Lithia is a $10 billion quoted US car dealer with sales beyond $30 billion and profit close to $2 billion:

Lithia could prove pivotal to Pinewood’s ambitions to establish itself within the lucrative US DMS market.

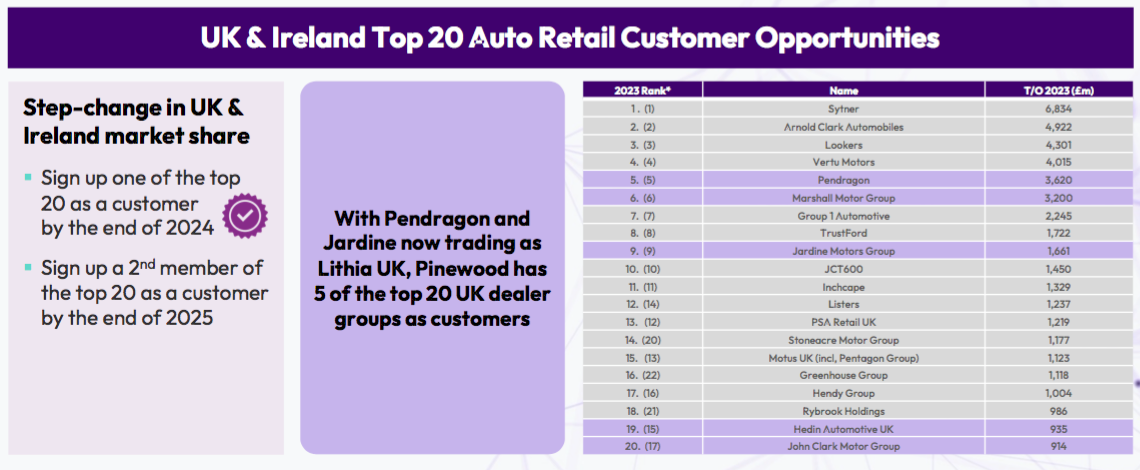

For now, though, Pinewood remains a predominantly UK operation. Management disclosed during October’s Capital Markets Day the business enjoys an approximate 30% UK market share that supports about 80% of total revenue.

The same presentation listed five of the UK’s top 20 dealers as customers, although Marshall Motor had signed its contract only two days earlier:

Operating as a Pendragon subsidiary for 25 years does not make Pinewood’s financial history straightforward.

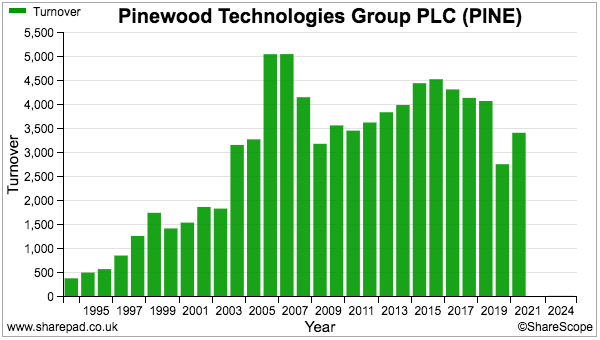

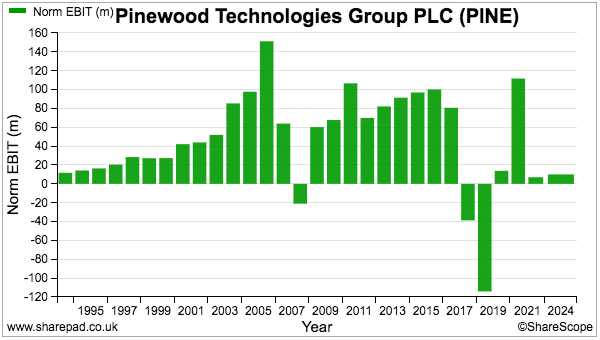

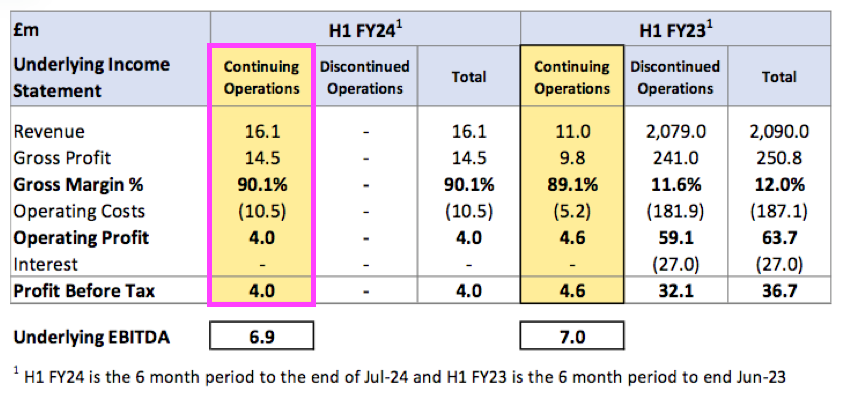

Indeed, Pinewood is unlikely ever to be shortlisted on many ShareScope filters given the group’s revenue and profit include decades of contributions from the now-sold dealerships:

Still, Pendragon’s old annual reports do reveal Pinewood’s revenue from customers outside of Pendragon’s ownership more than doubled between 2012 and 2022:

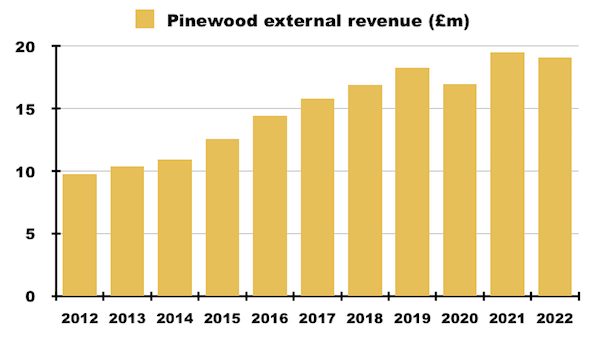

Pinewood’s annual results published last April showed revenue of £25 million leading to a £10 million profit:

Interim figures published during October then showed revenue of £16 million to suggest annualised revenue had become £32 million:

However, greater development costs were incurred during the half and, at the time, profit for this year was guided to reduce to £8 million.

But Pinewood’s current profitability might be somewhat academic given the group’s confident guidance.

When the Pendragon split was announced, Pinewood said its 2022 Ebitda was £15 million and claimed Ebitda of £27 million could be achieved by 2027. That forecast was upgraded during October’s Capital Markets Day to £30 million:

Pinewood tantalised investors when announcing the Pendragon split with the following 13-15x Ebitda-bid-multiple commentary:

“In addition, within the DMS sector, acquisitions of competitors to Pinewood have occurred at attractive multiples, notably Francisco Partner’s acquisition of CDK International and Brookfield’s acquisition of CDK Global at approximately 15 times and 13.3 times last twelve months’ adjusted EBITDA to enterprise value respectively. These transactions further validate the potential for the shares of the Company to trade well as an independent SaaS business.”

Achieving EBITDA of £30 million and attracting a bidder prepared to pay, say, 14x EBITDA would value Pinewood at £420 million…

…versus a £300 million market cap at the recent 345p share price.

Dealer Management Software

Pinewood’s DMS offers shareholders four main attractions:

1. Recurring income: Customers pay regular subscription fees (Pinewood deems 85% of its revenue to be recurring);

2. Customer loyalty: ‘Churn’ has been less than 2% during the last three years;

3. International potential: The same system can be rolled out overseas (sales are presently generated within 20 countries outside the UK), and;

4. ‘Scalable’ growth: Additional sales ought to convert mostly into profit if development costs can be controlled.

The attraction of Pinewood’s DMS to customers is generally the time and money saved by implementing a modern IT service to replace a collection of legacy systems and manual processes.

Pinewood’s website touts “automotive intelligence” and “forward-thinking,,, next-generation dealership technology” that helps “unlock the value in every customer“.

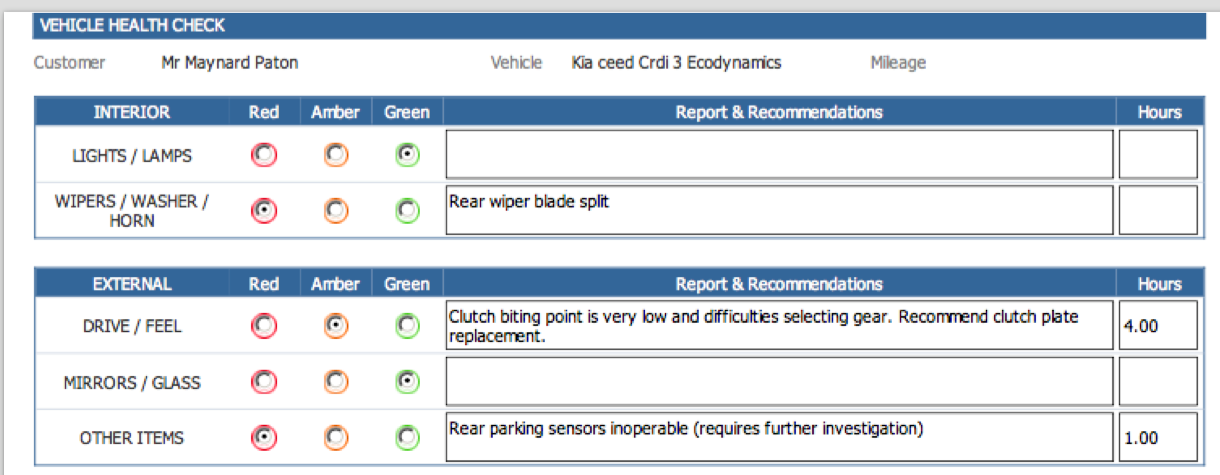

But I must admit the communications I received through Pinewood’s DMS did not exactly appear cutting edge. A simple emailed PDF gave me the bad news about my car:

I was also invited to log on to a primitive website to watch a three-minute video of the mechanic showing what needed fixing:

Nonetheless, my local dealer plus many others all seem happy with Pinewood’s DMS. The group boasts lots of glowing testimonials and, at the last count, some 34,300 employees of UK and overseas dealers used the system.

Going on October’s interims, I calculate Pinewood charges an average of approximately £800 per dealer employee a year for its DMS (£16 million total H1 revenue * 85% recurring * 2 / 34,300 users).

£800 a year or £66 a month per employee does not seem extortionate, and a quick online search for ‘UK dealer management software‘ reveals numerous suppliers that presumably keep the sector’s pricing in check. Smaller alternatives such as Dragon2000, VirtualYard, Malyar and MotorDesk all offer free trials with plans from £30 a month.

Growth and North America

When the Pendragon split was announced, Pinewood claimed its user count could increase by 16,000 to 48,000 by 2027. The prospective extra users were located as follows:

- UK Rollout (c.2,500);

- Other UK & Ireland (c.3,500);

- Europe (c.4,000);

- Middle East (c.1,500);

- Asia-Pacific (c.4,000); and

- Africa (c.500).

‘UK Rollout’ refers to the 50 UK dealerships owned by Lithia before its purchase of Pendragon. The associated 2,500 employees are now in the process of adopting Pinewood’s DMS.

The prospective 3,500 additional ‘Other UK & Ireland’ users will have to be upgraded following the aforementioned Marshall Motor contract win. Companies House shows Marshall Motor employing approximately 5,000 staff, most of whom presumably need access to a DMS.

A promising European market is Germany, which Pinewood claims is served by 20 different DMSs — none of which has more than a 10% market share and all of which are said to be struggling with outdated tech.

In fact, “multiple” German dealers have contacted Pinewood about a potential contract, and the German market “initially” offers a possible 20,000-plus new users.

Within Asia-Pacific, Japan appears an encouraging market given Pinewood’s new contracts with the country’s Porsche and VW/Audi dealers.

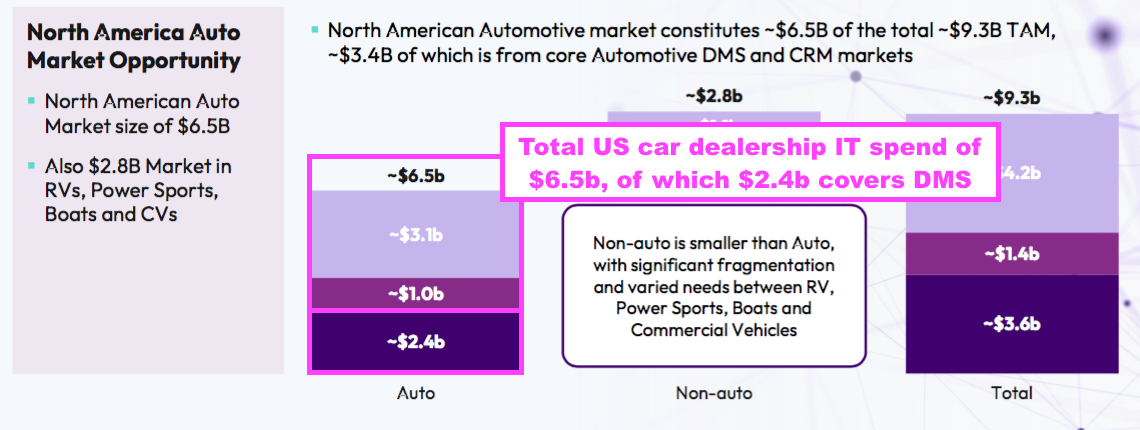

But the United States is the country that could really turbo-charge Pinewood’s overseas efforts, and major shareholder Lithia may prove vital for outsized shareholder returns.

Plans are afoot to implement Pinewood’s DMS into Lithia’s c320 US dealerships, which employ a combined c18,000 workforce. A pilot implementation should launch this year in one or two states:

320 US dealerships with 18,000 employees paying my estimated £800 per employee equals potential recurring US revenue from Lithia alone to be £14 million…

…and Lithia’s 320 dealerships represent just a fraction of the total 21,000 dealerships within the States.

Indeed, the typical US dealership apparently spends between $250k and $300k a year on its DMS and other IT services. The country’s addressable DMS market is said to be $2.4 billion:

Note that Pinewood’s US potential may have increased after CDK Global, a prominent DMS supplier in the States, suffered a cyber attack that took its systems down for two weeks last year.

Employees and expenses

Although Pinewood offers a persuasive growth story supported by a confident Ebitda projection, the business has yet to exhibit true ‘scalable’ qualities.

For example, annualised revenue from the 263 employees during the first half was approximately £125k each — which does not feel impressive for a ‘platform’ SaaS business with a prominent UK market position.

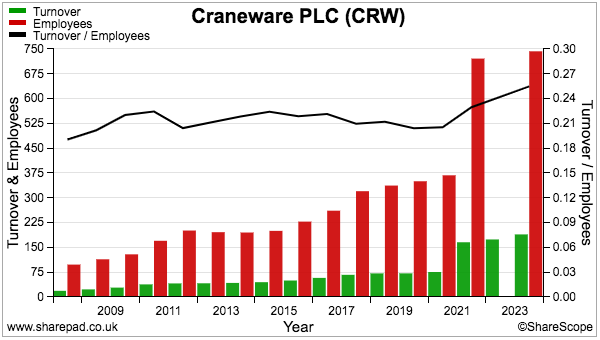

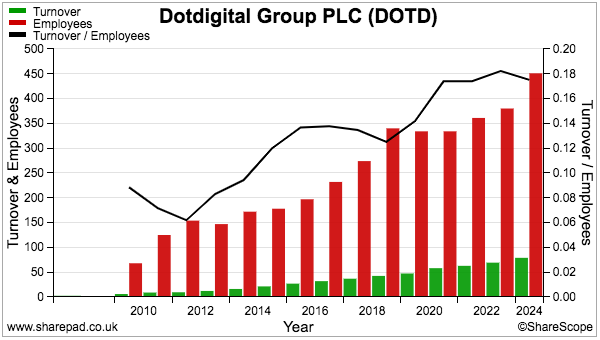

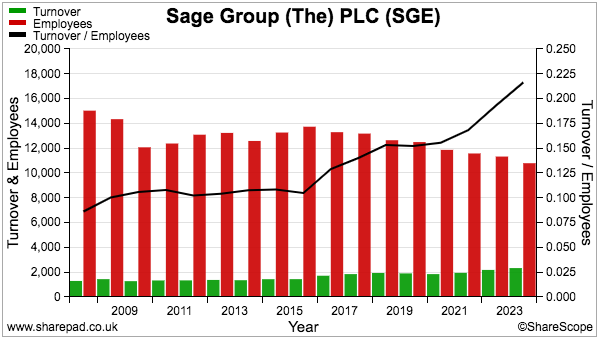

For perspective, software firms Craneware (US healthcare), DotDigital (email marketing) and Sage (accounting) enjoy significant annual recurring income and boast revenue per employee approaching £200k or beyond:

Extra sales may well eventually take Pinewood towards the £200k per employee mark. However, a fair amount of investment seems required in the meantime.

For instance, £10 million has already been invested in a Lithia joint venture to underpin the US expansion — a positive return from which will probably not arrive until 2027 at the earliest. A further $4 million has meanwhile been spent acquiring an AI chatbot developer.

Note also that Pinewood’s tantalising EBITDA projections do not entirely capture the group’s development expenditure. I estimate such expenditure runs currently at £9 million a year, with about £8 million capitalised onto the balance sheet rather than charged directly against profit.

Director pay is also worth spotlighting now that Pinewood has become a standalone operator

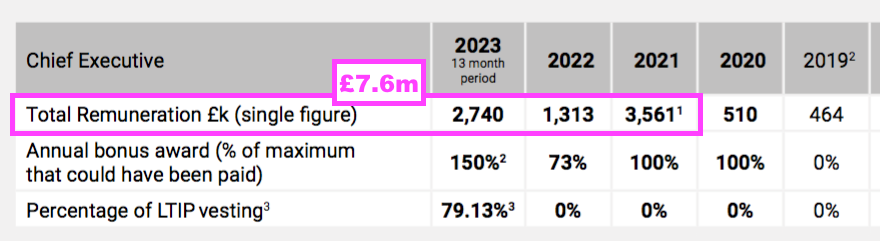

Pinewood’s chief executive Bill Berman became Pendragon’s boss during 2020 and collected a hefty £7.6 million between 2021 and 2023 through a mix of wages, bonuses, pension contributions, benefits and LTIPs:

That £7.6 million may have been acceptable running Pendragon with its £100 million operating profit, but perhaps is less acceptable running Pinewood with an operating profit currently less than £10 million.

Mr Berman’s remuneration continues to rankle and last year his new LTIP triggered a 20% protest vote.

Not helping matters was the new LTIP’s minimum 10% total-return hurdle having already been achieved at the time of the scheme’s publication! Mr Berman’s LTIP seems to be currently worth £1 million and might reach up to £8 million

But maybe Mr Berman is worth it. He is a lively American and used to be chief operating officer for America’s largest car retailer — which ought to be very relevant for Pinewood’s Stateside ambitions.

Lithia certainly appreciates Mr Berman; it paid him a £1 million “transition bonus” simply for staying on after the Pendragon split.

Valuation and verdict

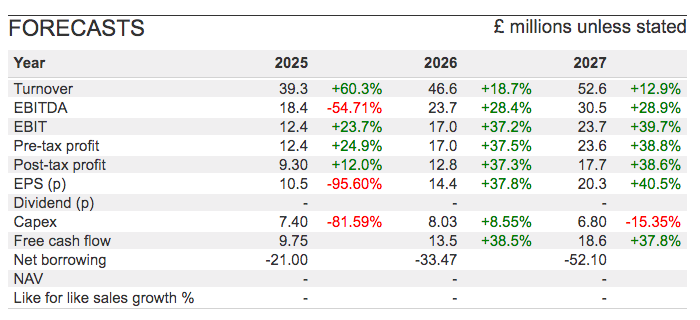

Pinewood’s £30 million EBITDA projection for 2027 is unsurprisingly mimicked by brokers:

Brokers also reckon 2027 will see revenue of £53 million and an operating profit of £24 million, which implies the operating margin will reach a superb 45%. Net cash expected to build to £52 million is another promising sign.

Earnings of 20p per share anticipated for 2027 support a 17x P/E at 345p, which could offer upside in light of the near-40% profit-growth rate predicted to be achieved in the meantime.

Note that Mr Berman’s new LTIP pays out in full if the market cap reaches £582 million during 2027, which on the current share count equates to 670p.

But will Pinewood achieve its £30 million 2027 EBITDA?

Very few quoted companies are confident enough to issue bold profit projections, but Pinewood’s ambition does seem plausible, assuming another Marshall Motor-type contract, early success in Germany/Japan, and some up-selling/price increases for existing customers.

And very few shareholders will quibble with Mr Berman’s LTIP if Pinewood does hit the big time within the States.

Perhaps the most likely downside is development expenditure and/or US start-up costs running much higher for much longer than expected. The superior economics of this “pure-play SAAS” may therefore take some time to emerge — if they ever do.

And I must highlight the razzamatazz of Pinewood’s “automotive intelligence” is not exactly reflected by my local dealer’s service emails!

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Pinewood Technologies.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.