A screen for high insider ownership identifies GlobalData boss Michael Danson and his £500m shareholding. Maynard Paton delves into Mr Danson’s impeccable track record of creating, buying and selling data businesses.

I can’t be the only investor who likes to see directors aligned with ordinary shareholders by owning lots of stock.

Hence this revisit to an old screen to identify companies offering robust financials, respectable growth, a reasonable valuation… and useful insider ownership.

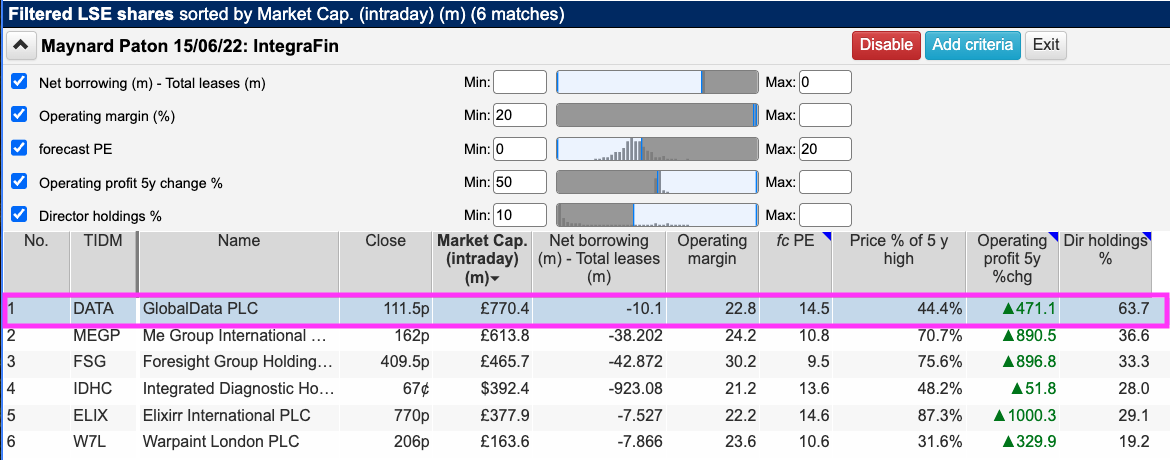

The exact criteria I redeployed for this search were:

- Net borrowings less total leases of no more than zero (i.e. a net cash position excluding IFRS 16 lease obligations);

- An operating margin of 20% or more;

- A five-year uplift to operating profit of at least 50%;

- A forecast P/E of 20 or less, and;

- The board owning at least 10% of the company.

I applied the screen the other day and ShareScope returned only six matches:

(You can run this screen for yourself by selecting the “Maynard Paton 15/06/22: IntegraFin” filter within ShareScope’s incredible Filter Library. My instructions show you how.)

I selected GlobalData because:

- The £770 million market cap was the largest on the list;

- The 64% board shareholding was the largest on the list, and;

- The shares were trading 56% below their five-year high.

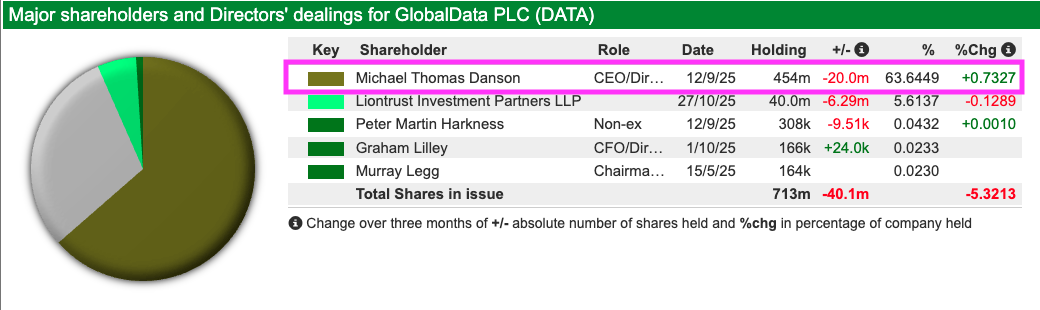

ShareScope reveals the board’s huge shareholding is held by GlobalData’s chief executive, Michael Danson:

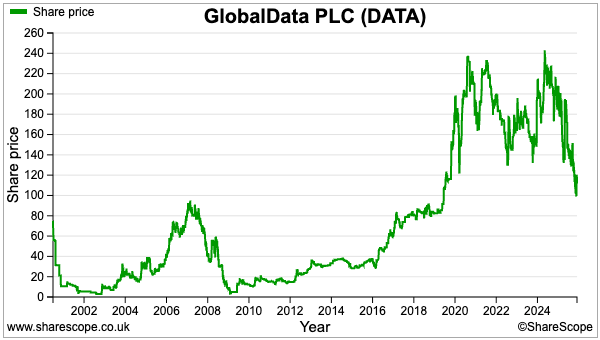

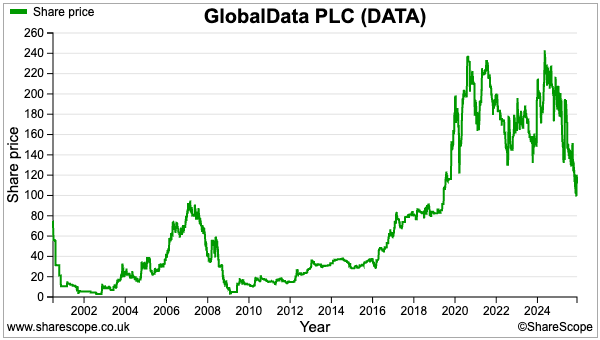

Mr Danson’s stake is currently worth approximately £500 million, and was worth more than £1 billion last year when GlobalData’s shares reached 240p:

Mr Danson might well be very motivated to return to billionaire status, or at least be very motivated not to see his immense wealth deteriorate further. Let’s take a closer look.

Introducing Michael Danson

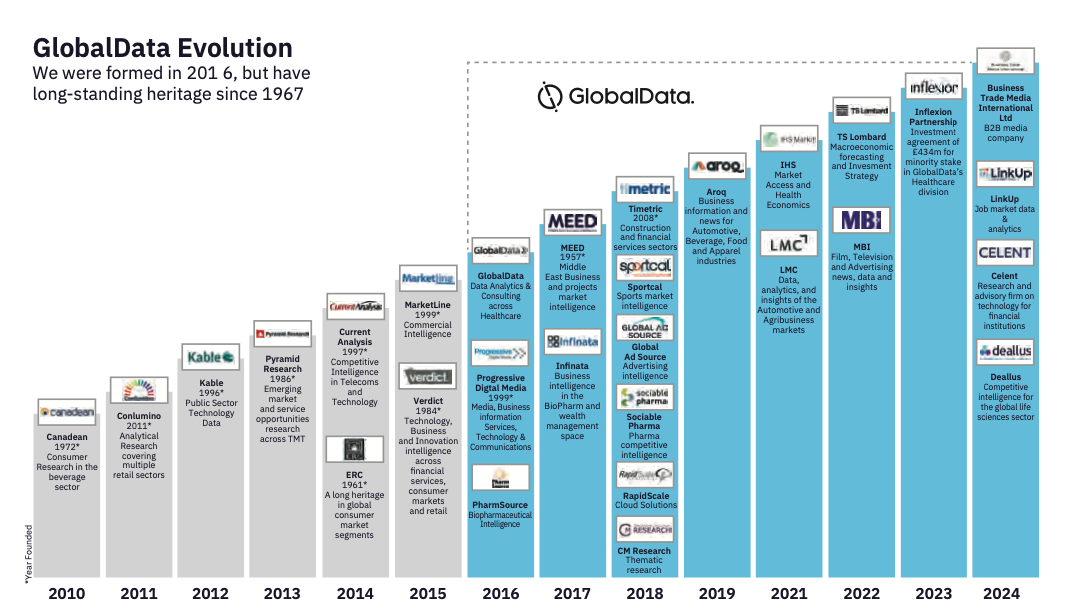

Mr Danson’s path to his GlobalData fortune commenced from a north London flat during the late 1980s.

After graduating with a law degree and starting out as a management consultant, Mr Danson used £5k of savings and several credit cards to establish Datamonitor, a subscription service that created detailed business reports from extensive databases of industry information.

An early investment by Reuters propelled Datamonitor’s growth during the 1990s that led to Mr Danson floating his venture during 2000. A rough few years then followed as the dot-com bubble burst, but Datamonitor survived, then thrived and was eventually purchased by quoted rival Informa during 2007.

Mr Danson’s 13% Datamonitor stake netted him £62 million and his 2007 exit — just like his 2000 flotation during the dot-com highs — was notable for its impeccable timing before a substantial market crash.

The 2008 banking crisis quickly provided Mr Danson with buying opportunities to reinvest his Datamonitor proceeds, including a 28% stake in quoted email specialist TMN and 100% of SPG Media, a B2B events firm.

During 2009 Mr Danson reversed SPG and several other B2B assets into TMN. The process resulted in an 85% stake in what would eventually be renamed GlobalData.

Mr Danson through GlobalData undertook numerous further acquisitions, notably during 2015 when the group spent £25 million to repurchase various Datamonitor operations back from Informa.

While Informa paid 7x revenue and 42x adjusted earnings for Datamonitor during 2007, Mr Danson repurchased those various Datamonitor operations for 1.4x revenue and 8x adjusted earnings.

However, Mr Danson was not quite as frugal with his acquisition valuations when he sold some of his private investments to GlobalData.

For example, Mr Danson sold his healthcare data provider to GlobalData for £67 million (3.5x revenue, 13x Ebitda) during 2016 and sold his energy/financials/construction/consumer data provider to GlobalData for £97 million (3.6x revenue, 46x Ebitda) during 2018.

GlobalData has spent more than £500 million undertaking 30 or so acquisitions since the TMN days:

Mr Danson’s majority shareholding and his tangled web of public and private investments prompted GlobalData’s board to form an unusual ‘Related Party Transactions Committee’ during 2020.

This committee comprises four non-execs and “ensures there are adequate controls in place to provide assurance that any transaction which is or may be a related party transaction in nature is conducted on terms that are at arm’s length and reasonable.”

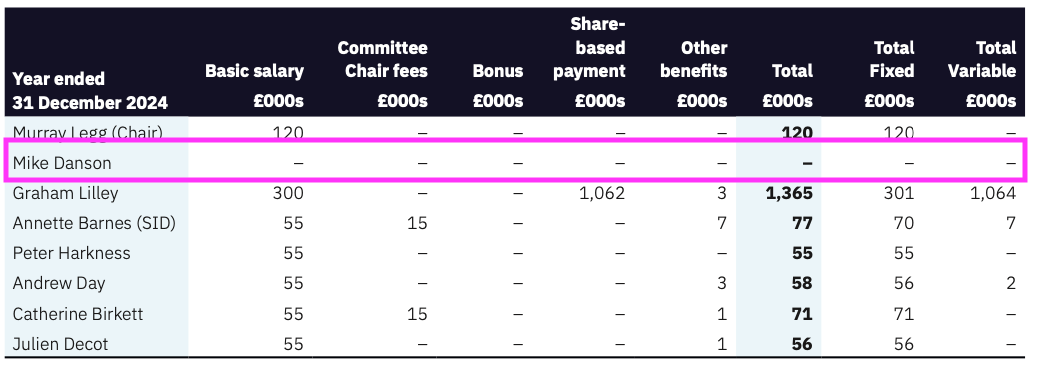

Mr Danson’s pay is thankfully not a matter that requires much investigation. His annual salary has been zero since 2018 and he collects no benefits nor bonuses nor owns any options:

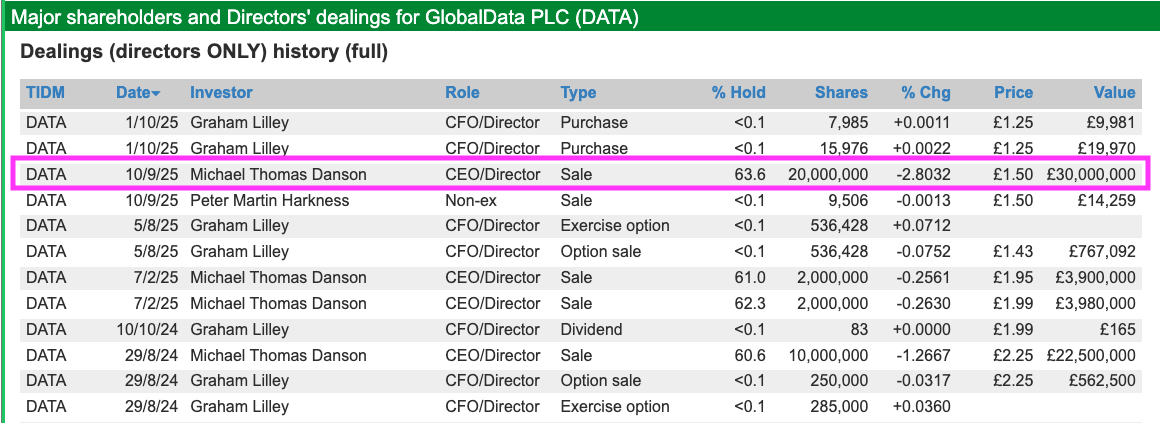

Mr Danson is 63 years old and I imagine he will remain in charge of GlobalData for at least a few more years. But he has trimmed his shareholding over time. ShareScope in fact indicates his disposals have raised more than £200 million since 2018 and the last share sale was conducted during September at 150p and raised £30 million:

Introducing GlobalData

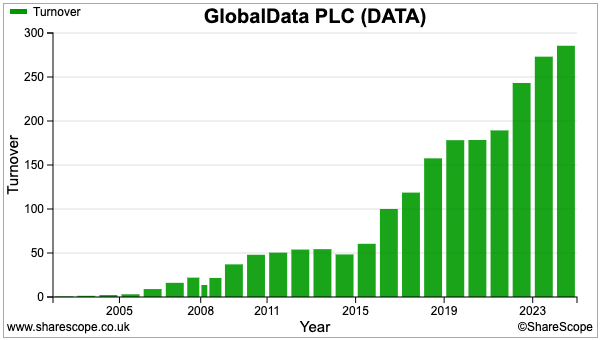

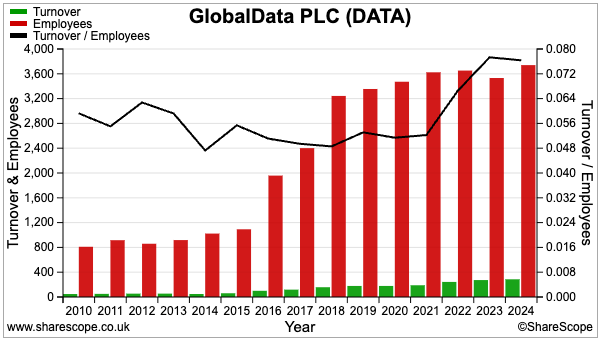

Mr Danson’s fondness for M&A has pushed GlobalData’s revenue from approximately £50 million towards £300 million during the last 15 years:

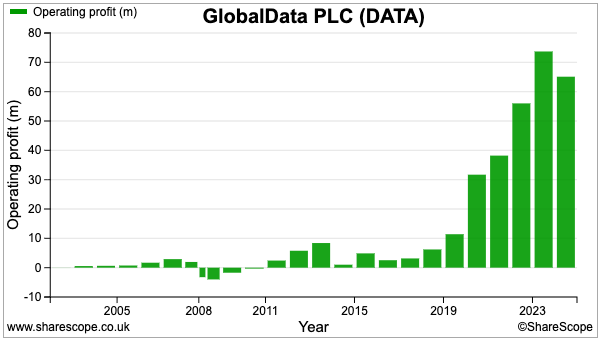

Reported operating profit has meanwhile surged from zero to £65 million:

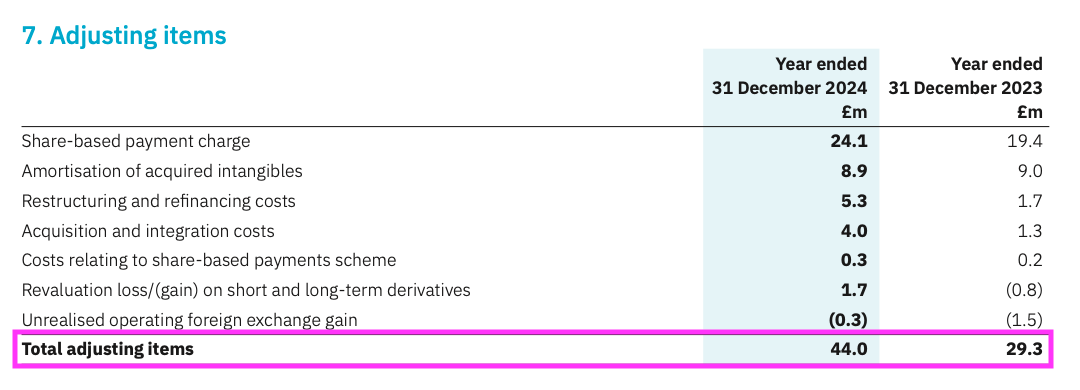

GlobalData’s profit is typically subject to a number of ‘adjusting items’. The 2024 results for example suggested operating profit would have exceeded £100 million were it not for various charges amounting to £44 million:

Whether all these charges are genuinely ‘adjusting’ is rather debatable. In particular, the last ten years have witnessed regular restructuring, refinancing, acquisition and integration costs amount to £42 million. Such expenses appear inherent to GlobalData’s M&A strategy.

Deloitte even supplied a mild ticking off about the adjustments within its 2024 audit report:

“We note that whilst the use of adjusting items is relatively extensive in comparison to industry peers, they are in line with the accounting policy, consistently applied and adequately disclosed.”

Today GlobalData describes itself as a “data, insight and technology company that provides decision-makers across the world’s most successful companies with the intelligence to act with conviction.”

Close to 5,000 clients use the group’s “connected platform“, which “uniquely integrates proprietary data, expert insight and purpose-built AI into a unified operating system that powers the next generation of intelligence solutions.”

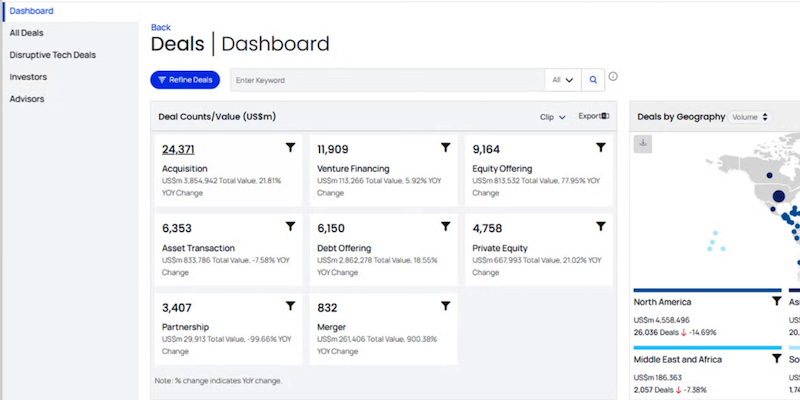

GlobalData’s website and presentations are sadly brimming with even more buzzwords. From what I can tell, clients sign up to access information collected from 500k-plus sources covering 20-plus industries that encompasses all manner of data — from market shares and company accounts to job listings and patent applications:

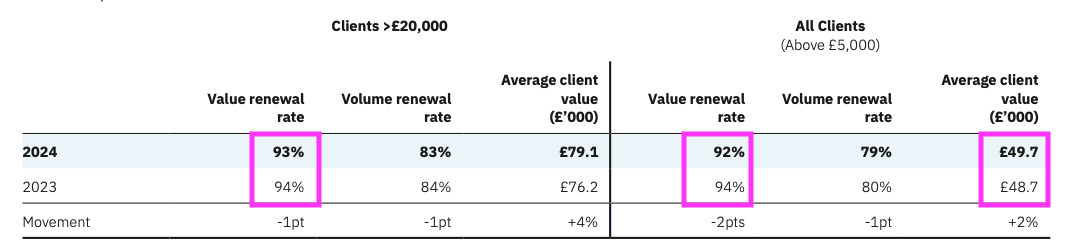

Clients normally subscribe to GlobalData’s services for a year and during 2024 spent an average £50k each. Renewals measured by subscription payments top 90%:

GlobalData’s largest spenders — those paying more than £100k annually — appear particularly loyal with a renewal rate of 98%:

“During 2024, our volume renewal rate for clients spending more than £100,000 was 98% (FY23: 97%), which reflects a client base of 431 clients (FY23: 406) with an accumulated value of £123m (FY23: £114m).”

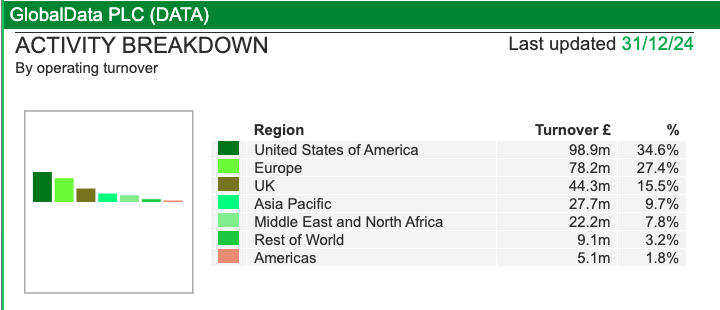

The top 431 clients spent an average £285k each last year and their £123 million aggregate expenditure supported 43% of total revenue. Big-name customers listed on GlobalData’s website include Nestle, John Lewis, AstraZeneca, Vodafone and Aon. Sales are generated primarily in the United States, Europe and the UK:

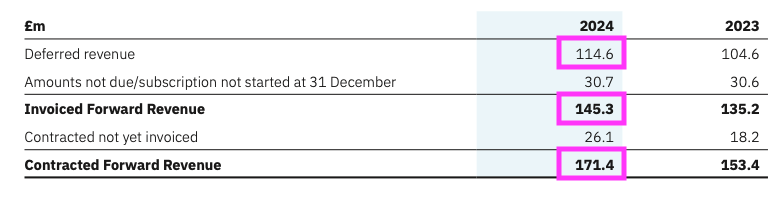

Annual subscriptions ought to provide GlobalData with reliable revenue. Depending on your view of the accounting, upfront customer payments of £115 million, £145 million or £171 million — equivalent to 40%, 51% or 60% of 2024 revenue — were already secured at the start of 2025:

Financials

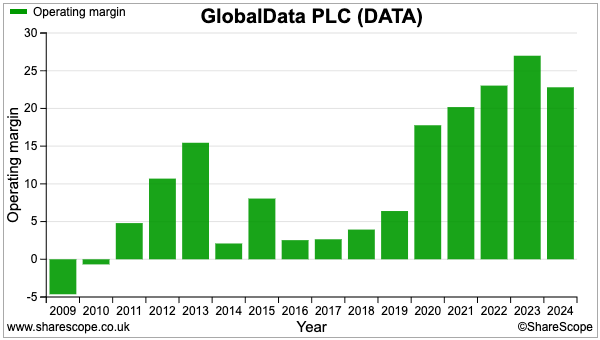

My initial filtering had already identified GlobalData’s 20%-plus margin, and ShareScope shows such healthy profitability occurring since 2021:

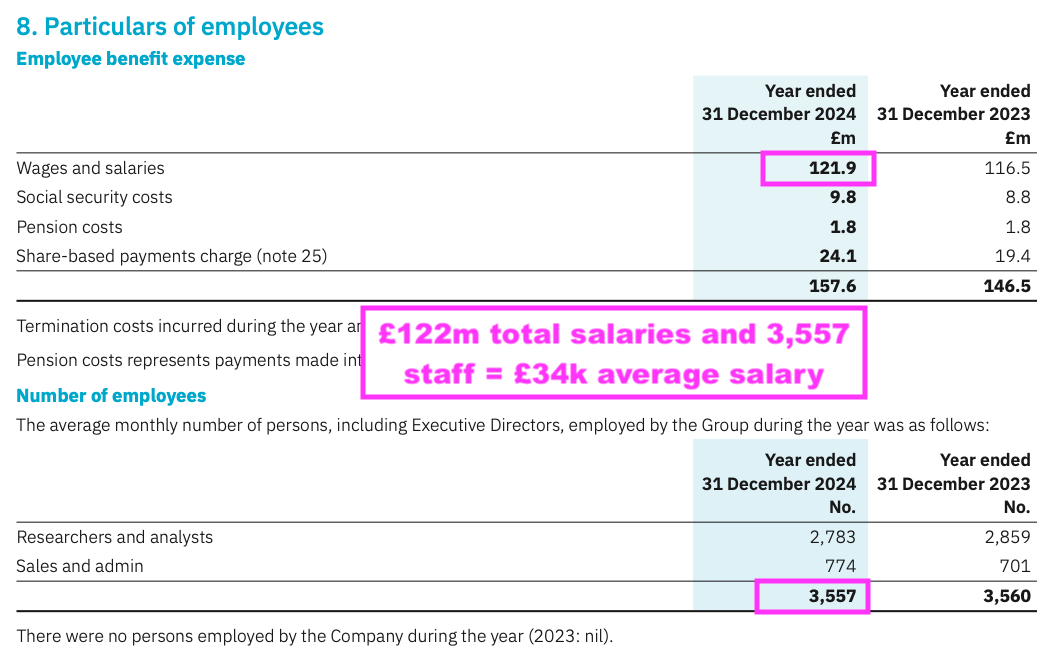

Lowly paid employees underpin the group’s decent margin. Last year some 3,557 staff collected aggregate salaries of £122 million — or just £34k each:

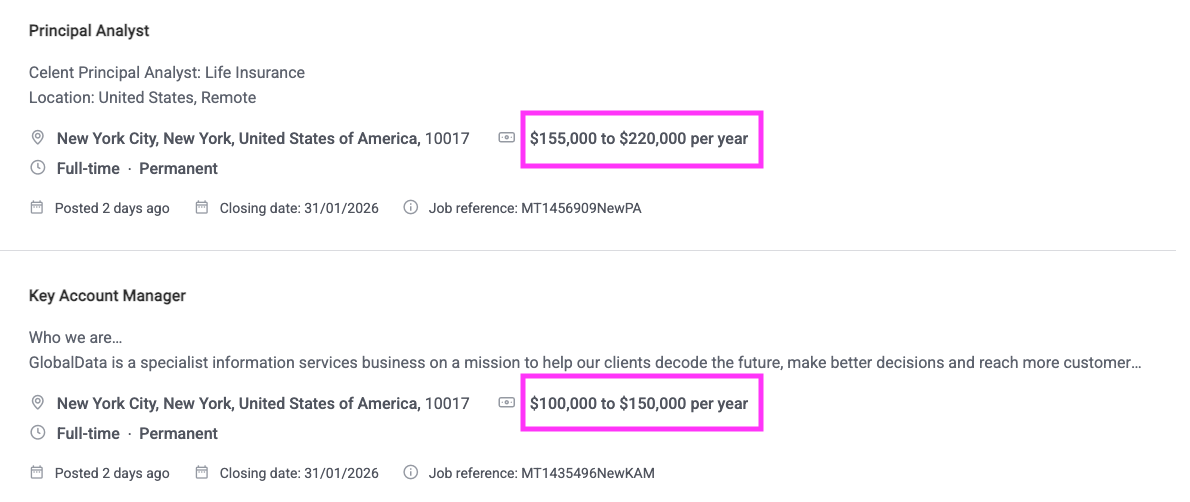

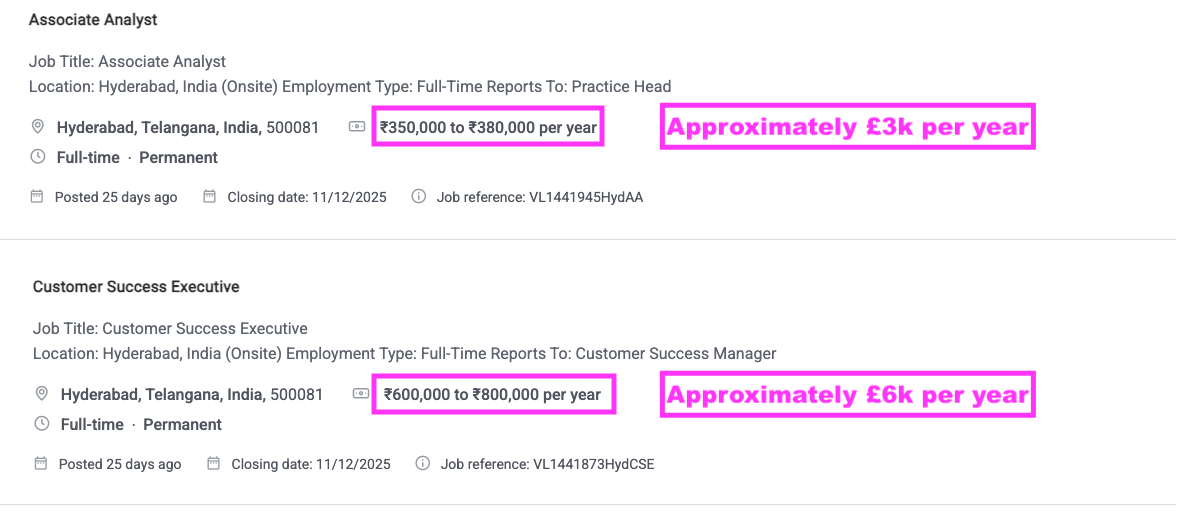

An average £34k salary seems very low for a seemingly sophisticated data business. Sure enough, careers at GlobalData include well-paid jobs in New York…

…but also jobs in Hyderabad that pay less than £10k:

Revenue per employee at approximately £80k again seems low for a seemingly sophisticated data business…

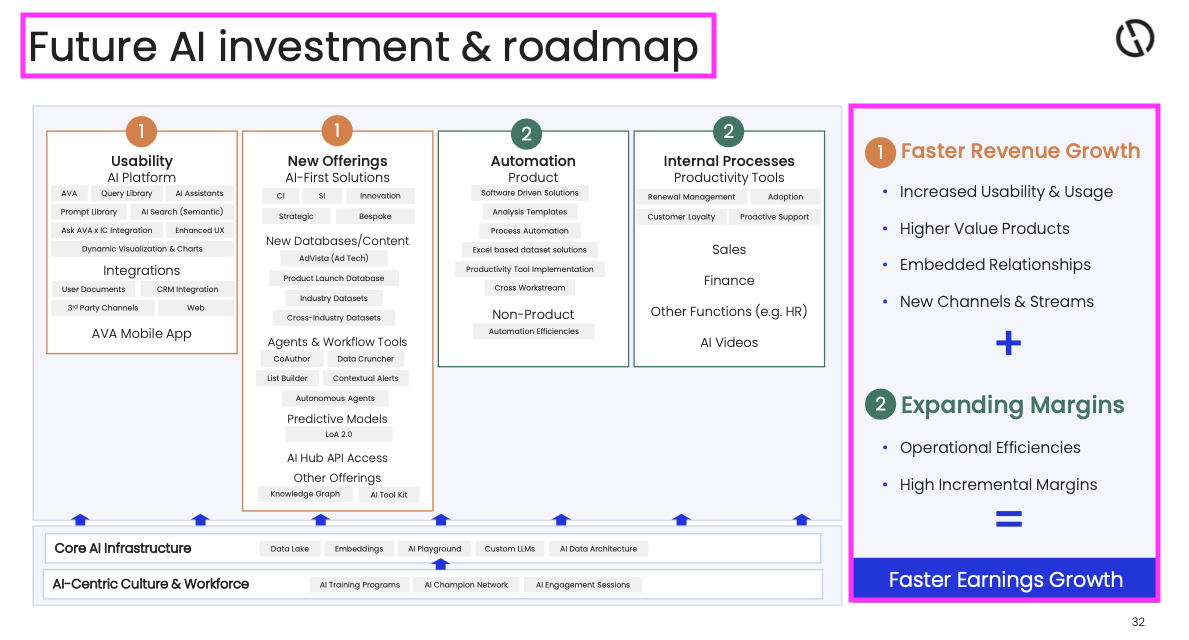

…which might be why a recent investor event was devoted entirely to AI (more on which later).

My initial filtering also identified GlobalData’s net cash position, which stood at £10 million at the end of 2024:

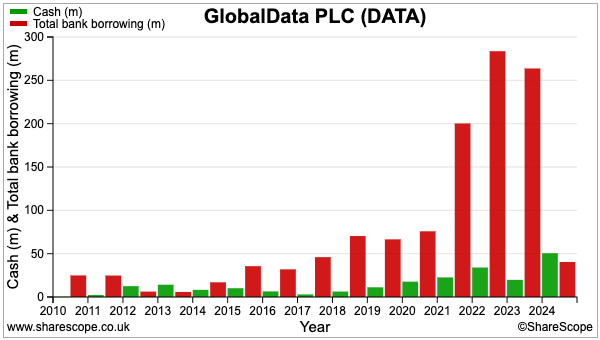

The £10 million net cash position appears to be a freak event — GlobalData operated with net borrowings between 2015 and 2023 and seems unafraid of employing substantial debt to fund all its M&A.

Further acquisitions during the first half of 2025 have since led to a net debt position of £16 million.

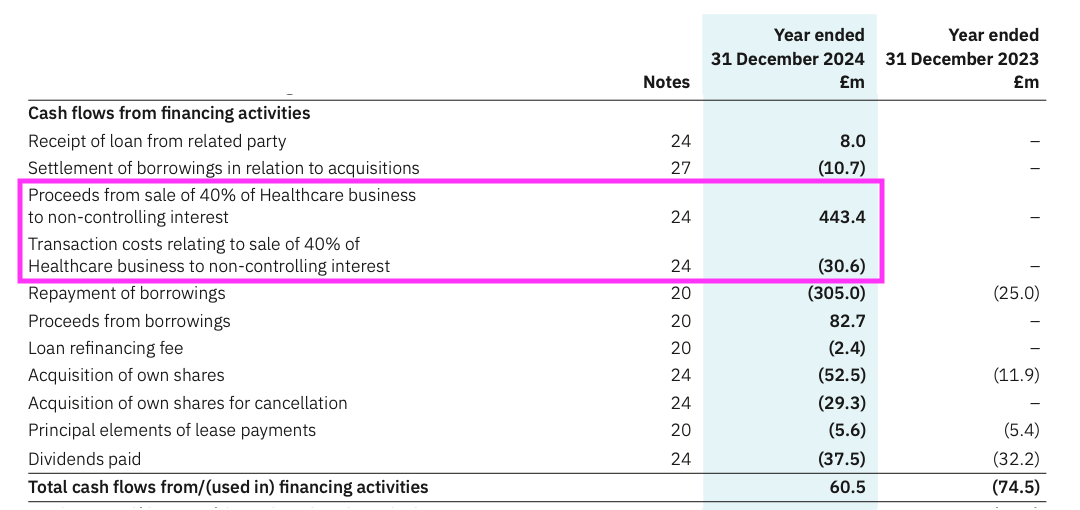

The rapid reduction to borrowings during 2024 followed a remarkable £443 million sale of 40% of the group’s healthcare-data division to private equity:

That transaction implied the entire healthcare-data division was worth £1.1 billion — which exceeds the group’s recent £770 million market cap! I see costs associated with this £443 million sale amounted to an enormous £31 million.

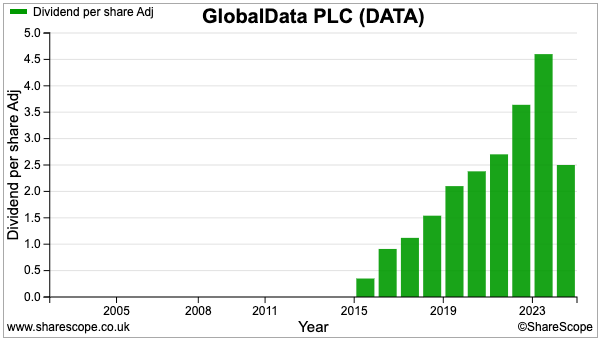

Note that the 40% disposal of the healthcare-data division prompted a “rebased” dividend in order to “focus more capital towards M&A“. Last year’s payout was cut by a massive 46%:

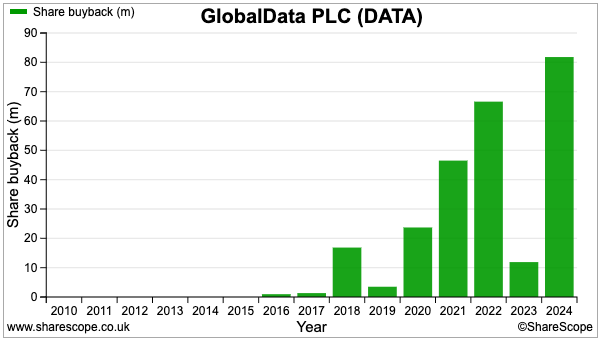

However, cash has not been withdrawn for buybacks, with £82 million spent last year…

…and at least a further £100 million spent during 2025, including £60 million through a tender offer at 150p.

That aforementioned £30 million share sale by Mr Danson was in fact conducted through this 150p per share tender offer… and the shares trading recently at 111p suggest this tender may have been prompted by Mr Danson wishing to sell rather than GlobalData wanting to buy.

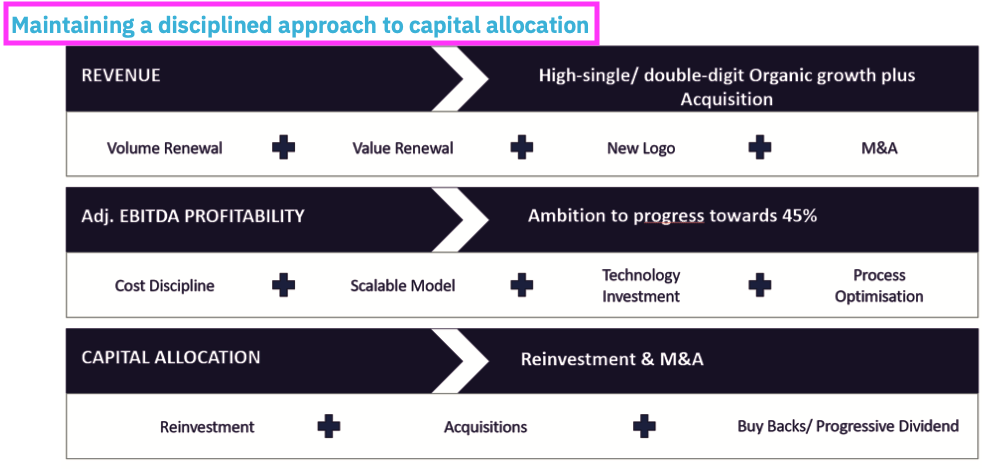

Although GlobalData refers to a “disciplined approach to capital allocation“…

…ratios that appraise the value created by the extensive M&A — such as return on equity, return on capital employed or return on total invested capital — are unfortunately absent from GlobalData’s KPIs.

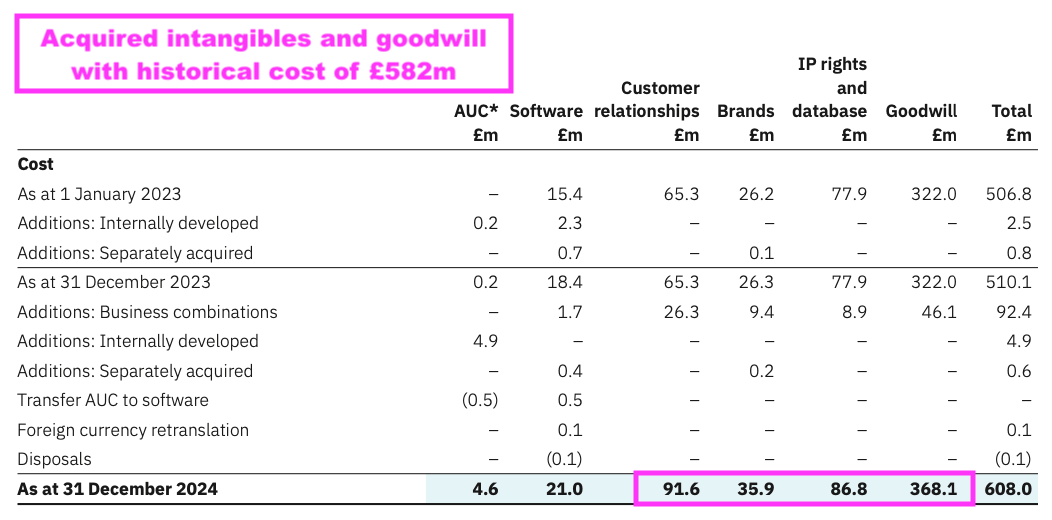

In an attempt to calculate a rudimentary return on the M&A investment, I see the 2024 accounts show acquired intangibles with a historical cost of £582 million:

With reported operating profit at approximately £65 million, arguably the pre-tax return on all the M&A expenditure has been 65/582 = a reasonable 11%. The pre-tax returns on equity should of course be higher than 11% given GlobalData has funded much of its M&A through debt.

Valuation and verdict

After starting from scratch less than 40 years ago, Mr Danson has since built two significant data businesses and clearly understands how to create long-term wealth.

A knack also for judging when to exit entirely — and subsequently buy back in — certainly marks Mr Danson as an entrepreneur to follow.

But should you follow him into GlobalData? August’s half-year results implied the shares were a “compelling long-term opportunity”:

“[We] believe our continued investment in the business and platform, our strong balance sheet, cash flows and significant M&A firepower offers shareholders a compelling long-term opportunity for strong returns.”

The market has its doubts though, given the shares have slumped to levels first achieved six years ago:

Those August half-year results were not overwhelming. Underlying revenue gained only 1% due to “macro headwinds” while adjusted earnings per share dropped 21% as costs increased to revamp the sales force and introduce AI.

AI could be what makes — or possibly breaks — GlobalData. An investor event last month provided 50-plus slides on how AI investment would eventually lead to faster sales growth and higher margins:

But supplying data analytics and research — and enjoying those healthy margins — would seem ripe for AI disruption of some form…

…and maybe the extra AI investment is purely to counteract clients leaving for cheaper AI alternatives. I note much of the group’s data appears sourced from public filings and websites and GlobalData’s investor event at the start of 2023 never mentioned AI.

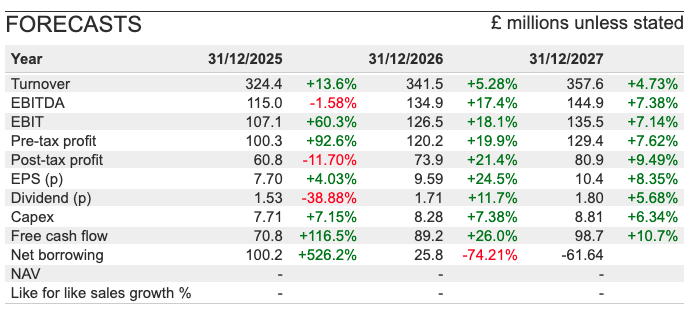

ShareScope carries the following forecasts:

The profit advances expected for 2025 and 2026 are complicated somewhat by recent acquisitions. But the projections for 2027 anticipate high single-digit growth, which seems a reasonable ‘underlying’ growth rate for GlobalData to deliver — barring any AI disruption.

Assume the forecasts prove accurate, and the possible 14x P/E for 2025 reduces to 11x for 2027.

While the rating does not look extended given the group’s past expansion, the forecasts are not exactly what GlobalData had expected at the start of the year. Mr Danson in fact claimed in March the business was “confidently progressing toward our target of £500m annualised revenue by 2026″. He needs to undertake some major acquisitions very soon to get close to that £500 million.

A very intriguing development occurred during April when GlobalData received separate, preliminary cash offers from two private-equity firms.

The shares immediately rallied from 140p to 190p, but the discussions were terminated less than two months later. Although I would never bet against Mr Danson, I am not quite sure why he chose then not to agree a cash exit.

Perhaps the indicative offers were too low. Or perhaps the two interested parties discovered something they did not like. Or perhaps Mr Danson felt a major buying opportunity would at some point arise in an AI-worried market.

Were the share price to fall further, I could easily imagine Mr Danson believing the best way to return to billionaire status would be to utilise that £200 million he has realised from his earlier share sales…

…and acquire the 36% of GlobalData he does not own for himself.

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in GlobalData.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Looks interesting and will do some more research………………

That filter “Maynard Paton 15/06/22: IntegraFin” no longer seems to exist in the library.