In his first guest article for ShareScope, experienced small-cap investor Paul Scott shares his insights on the latest profit warnings, market patterns and potential recovery opportunities from the September results season.

Hello from Paul Scott. This is the first of a series of guest articles I’ll be writing for ShareScope.

Who am I?

I’ve been a professional investor, focusing on small (and more recently) mid cap UK shares, since 2002. Prior to that I trained as a chartered accountant with PWC (but flunked my finals exams due to too much partying in the 90s, well the music was out of this world), then fell into a CFO job by accident really (right place, right time) for a small chain of ladieswear shops called “Pilot”. I ran the group finances for 8 years as we did a breakneck expansion from 16 shops to over 150, including several in Europe.

So in summary, I’ve checked the numbers (as an auditor) and been trained what to look for. Then as a CFO I actually ran the finances of a rapid growth business for 8 years.

All the above makes for pretty good hands-on experience in what to look for, good or bad, in company accounts, and business models generally.

My investing track record

Very much boom and bust. Several times. I won’t go into the details, but basically, I’ve made and lost millions in the stock market, several times. That’s because my personality is entirely unsuitable for investing – I’m wildly over-excitable, with little self-control. So investing is probably the last thing I should be doing!

Gearing has been my achilles heel – I’m drawn to gearing like a moth to a flame. That said, my ungeared portfolio has done OK. I’ve measured the figures since 2012, and it has compounded at +13% pa up to now, which means the funds in my SIPP have roughly 5-bagged. It could & should have been a lot more, but I made a lot of daft mistakes in that account too.

Most years I make 20%+ overall, and that is a perfectly achievable target if you can control yourself, and invest sensibly in decent companies. Then obviously the odd year is horrible, and everything goes down.

In 2022 and 2023, my published list of top 20 share ideas for further research by readers, beat AIM by 30% in both years. This year is probably not going to be a hat-trick (that would be greedy!) and I’m presently only up 6.5% YTD (plus divis), which is 4% behind AIM All Share. I picked too many cyclical recovery shares, not knowing of course that the Trump tariffs would trigger another round of chaos. So being up at all is a reasonable outcome I suppose.

Shares research

I think we’ve established then that I’m certainly not a tipster, or a genius investor! But I do absolutely love researching companies, dissecting accounts, and discussing my thoughts with other investors. It’s like doing a puzzle, and each day throws up exciting news of takeover bids, profit warnings, contract wins. There’s nothing quite like spotting an overlooked gem, piling into its shares, and making a load of money from it.

Plus of course inevitably all the profit warnings and mistakes, which all investors suffer. We like to think all of this is scientific, but it’s also partly an art. Some of the most successful investors are not that good with numbers, but know how to assess and back the right management. Hence why I find it so useful to share ideas with other investors, for me it’s very much a team sport.

Why invest in small-mid caps?

I’m not advocating any particular investing strategy – that’s for you to decide – it’s your money, so your choice.

However, good stock pickers can and do make very good returns most years in small caps.

There’s a strong argument for having at least part of our portfolios in bargain UK small cap shares. There are lots of skilled investors out there, in my network, who I’ve seen achieve superb returns year after year. But you have to be disciplined, with a set of rules to avoid the worst shares. I strongly believe in drawing up your own checklist of simple things to check before buying any share – a good subject matter for a future article.

Positives

- UK smaller companies are often undervalued relative to private and overseas markets – driven by institutional selling due to redemptions – an opportunity for buyers.

- Many takeover bids, giving typically an instant 30%+ profit – I’ve had three in my favourites so far this year.*

- Strong balance sheets are common for small caps, especially family-owned companies, providing safety and hidden value.

- Dividend yields can be generous, providing a good flow of income whilst we wait for shares to rise.

- Little competition – few in the City look at smaller companies, so bargains can lie on a plate for us, completely overlooked sometimes.

- Simple accounts for small companies are a delight to behold, allowing us to quickly assess large numbers of companies.

* Renold (which I flagged at 14p on a Mello investor show, with a takeover bid now c.80p), De La Rue, and H + T.

Negatives

- Lack of liquidity can make bid/offer spreads wide, and even impossible to deal at times.

- Overly dominant founders can de-list companies on a whim, so check the shareholder list carefully.

- AIM is full of junk – I would say half or more of AIM companies are dreadful,often run by spivs trying to get rich quick. But these are easy to spot, and avoid.

- Story stocks, with no proven commercial viability, frequently do repeated fundraises at lower prices, and rarely succeed commercially. Beware!

- Management quality is not likely to be amazing at all smaller caps, and they’re often overpaid relative to profitability & size of company.

My writing on shares

I first developed a love for writing about shares on the Motley Fool, posting as “paulypilot” which was a wonderful resource back in the 90s and early noughties.

Moving on to 2012, I was still smarting from my disastrous losses in the credit crunch, where I managed to lose £5m of my own money. The slight problem was that I only had about £3m to start with, so I went from a positive, to a negative millionaire.

After successfully and solvently paying off the creditors in an orderly fashion, I decided that I needed a much more thorough investing process, and started a blog which attempted to review all companies on the UK stock market within some boundaries (above £10m mkt cap, avoiding certain sectors such as natural resources, insurance, banks, and a few others).

Stockopedia spotted my blog, and invited me to become their in-house small caps writer, publishing my daily Small Cap Value Reports.

That project lasted an amazing 12 years, and was huge fun, building a smashing community of fellow small cap enthusiasts in the reader comments.

All good things have to come to an end, and in 2024 I decided to go it alone, and publish my own content on substack.

Paulypilot.Substack.com

It’s a freemium model, so Friday’s content is free as a shop window, then £120 pa for full membership. There’s a free trial option, or members can sign up for a monthly fee of £12, and no lock-ins – people can therefore try it out without any commitment, and cancel any time.

For that, subscribers get a team of 4 writers, who are all successful, mostly professional investors, who are steeped in UK shares over 20+ years each. We share a passion for analysing, and writing about shares – it’s more an obsession than a job!

We publish timely (before 8am for the first draft) summaries of the day’s most important news – results, trading updates, profit warnings, significant contract wins, etc.

Importantly, we also check the broker notes, to alert you to hidden profit warnings We then write more detailed commentaries on the most interesting-looking companies as the day goes on, typically 3-6 companies per day, but fewer when the newsflow is busiest (where we can cover 30+ companies in our summary tables).

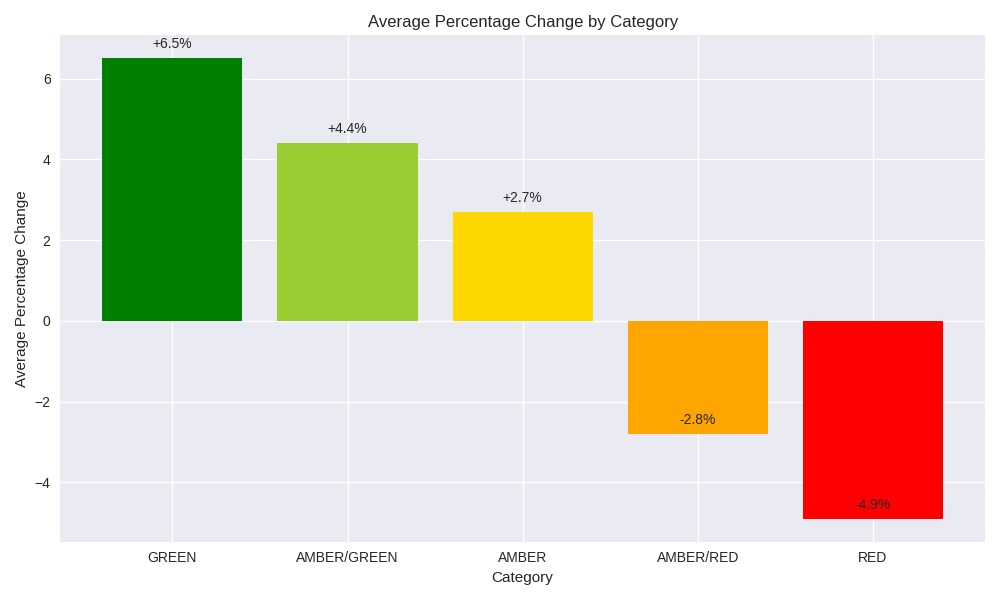

Colour-coding system – we view shares through a value/GARP (growth at reasonable price) investing method. So we won’t necessarily be flagging up the latest speculative 10-bagger, that’s not our thing. But we will flag up decent companies on reasonable valuations, that should do well longer term.

Importantly, we flag up riskier shares, with a proven success rate – our AMBER/RED and RED warnings have steered investors away from many disasters. ALL the companies that have gone bust this year were RED on our system.

I also record a podcast almost every weekday, summarising the day’s news.

NB. All my content is just my fallible personal opinions, reporting on the facts, figures & forecasts on that day. We’re not trying to predict the future at all, or tip anything. Doing your own more detailed research, and hopefully adding your own comments to our articles, is the key point. Remember we’re only doing quick reviews, of lots of companies, so definitely not recommendations – more detailed research is essential.

That’s enough for my sales pitch, let’s talk about some interesting shares in the recent results season (September was ludicrously busy for June interim results, which have to be published by end Sept).

Review of September’s RNSs

We reviewed 379 company announcements on my substack this September. That covers results & trading updates mostly, but also other significant announcements such as acquisitions, contract wins, etc.

Profit Warnings

Let’s have a look at profit warnings, to see if any patterns emerge.

We reported on 33 profit warnings (“PW”), that’s nearly 9% of the companies issuing significant news in Sept.

We define PWs as situations where a company either says it will miss forecasts, and/or brokers significantly reduce forecasts.

We detest hidden profit warnings, where companies release a cheerful-sounding RNS, but their broker slashes the forecasts, which recently happened with SPSY [I hold], and FOUR [I hold], GMS [I hold]. Maybe me holding a share is the problem here LOL? It’s probably more that I remember those specific cases because I hold the shares. There have been plenty of others. We’re planning on keeping a record of these, in a hall of shame to be added to my substack – we hate seeing private investors disadvantaged, when bad news is leaked out to the chosen few through premium broker notes, whilst you and I are kept in the dark. It’s appalling actually, and has to be stopped.

Most PWs come from smaller companies. Of the 33 PWs , only 3 came from mkt caps over £1bn, being:

- Jet2.com (slower holiday bookings),

- Baltic Classified (tax issues in Estonia), and

- PetsAtHome [I hold] with yet another mild profit warning from its retail division.

Of the 33 PWs, 21 came from companies with a market cap below £150m on the day. So as small cap investors already know, the risk of under-performance is higher at the smaller end, where delayed contracts in particular are common in the tough macro conditions we are currently enduring, which can often have a material impact on the whole company’s results.

Some patterns which I have spotted from this month’s profit warnings –

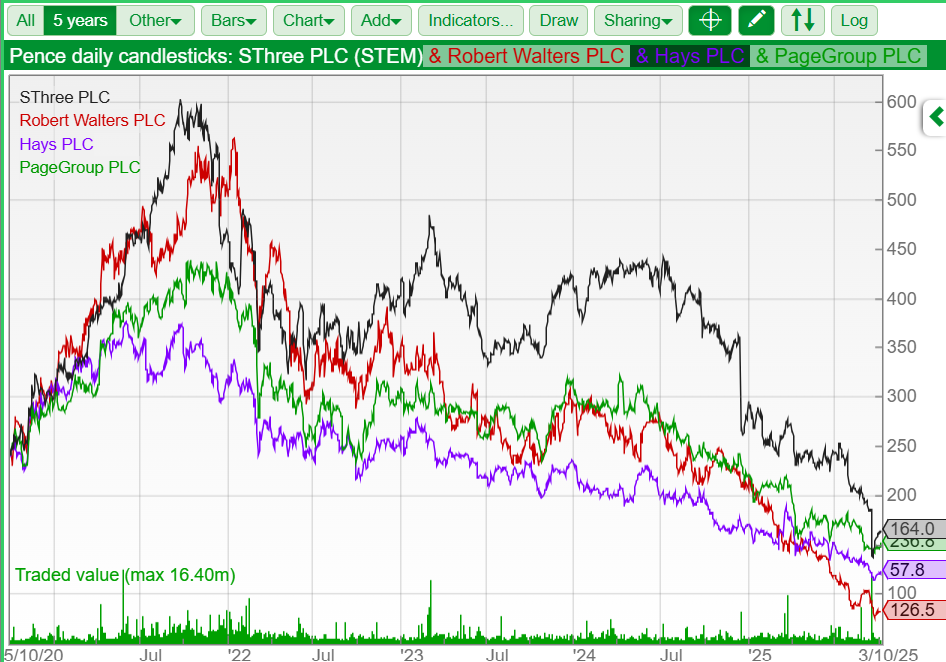

Staffing companies

SThree (STEM) slashed its forecast profit for next year (11/2026) from £30m to £10m. So there seems no sign of any recovery in this absolutely battered sector. Bargains galore for a cyclical recovery, or are companies using other methods to recruit? I’m not sure. Look at the 5-year share price chart for STEM below, which I’ve compared with sector peers RWA, PAGE, and HAS

Retailers

We’ve had profit warnings from 3 retailers this month. In all cases I think these are under-performing for company specific reasons, whilst the dominant retailers seem to be trading OK (eg Tesco recent upgrade, Next as always trading just fine).

PetsAtHome (PETS) – [I hold] – mild profit warning from under-performing retail division, but pets division (makes over half the profit) doing fine. AMBER/GREEN for me, as it’s still highly profitable & cash generative, and has ungeared balance sheet. New CEO could bring turnaround, and/or bid approaches from private equity maybe?

Asos (ASC) – lower end of profit guidance range. Losing money on a PBT basis (EBITDA here is fantasy) and with a weak balance sheet. Will it survive long-term? The numbers say to me not, but it could end up a trophy bid target for eg Mike Ashley? Higher risk, so AMBER/RED (risk warning).

Marks Electrical (MRK) – also ran electrical ecommerce business, now only trading at breakeven, after a series of profit warnings. Shares still look significantly over-priced to me. Maybe a victim of resurgent Currys and AO.com, both trading well, and with much greater buying power than MRK? Founder has overly dominant share, so high risk of it delisting. Hence an avoid for me, at AMBER/RED.

Building-related

We’re getting mixed messages from the building sector. Most companies are seeing little to no recovery, although the larger housebuilders generally sound cautiously optimistic I’d say. Things are not getting any worse for them anyway, although of course November’s Budget could tip things over the edge again.

We’ve had 4 profit warnings in Sept from related building supplies companies –

Michelmersh Bricks (MBH) – H1 profit down 26%, and sees FY12/2025 results similar to last year. Says Europe “very challenging”. We think shares are now looking attractive for the (eventual!) cyclical recovery. Strong, ungeared balance sheet. AMBER/GREEN from us (moderately positive).

Note that bricks distributor Brickability [I hold] put out a more positive update in Sept, in line with expectations.

Eurocell (ECEL) – said that conditions “remain subdued”, and profit would be below expectations, but didn’t say by how much! (How ridiculous). Broker consensus EPS forecast has dropped from c.9.5p to c.8.0p. Yield is good at 5%, and balance sheet sound. Could be a cyclical recovery candidate maybe?

Van Elle (VANL) – ground preparations specialist. Issued its third PW this year, blaming slow building regulatory approvals (we’ve heard this from several other building-related companies). Perhaps surprisingly it said the medium term outlook is “very positive”. Strong balance sheet, so we think it could be a nice relatively safe cyclical recovery investment perhaps? AMBER/GREEN.

Billington Holdings (BILN) – structural steelmaker, with profit outlook for 2025 slashed by half. Although it also makes positive noises about the outlook. Decent balance sheet here too. Could be another recovery play maybe? Mentioned “pricing pressure” for new work, so we decided to be neutral on this share, AMBER.

Holidays

My theory was that the superb spring/summer weather in the UK might reduce demand for overseas trips, which might be one of the reasons why this sector seems to be struggling a little?

Jet2.com – a mild profit warning on 4/9/2025. Sector headwinds, and people booking holidays nearer the departure date, so outlook vague. We like the company, and its bulletproof balance sheet, so remain moderately positive with a long-term view, AMBER/GREEN.

OnTheBeach – also warned on 24/9/2025, saying its FY 9/2025 profit would miss by about 10%. Hardly a calamity, but shares went into freefall. Why was anyone surprised, given Jet2’s news 3 weeks beforehand? We see this plunge as a potential buying opportunity, although probably taking it from overvalued to fairly valued?

Marketing

Probably the most difficult of all the sectors in recent updates.

As we all know, advertising/marketing/PR are often the first discretionary item of spending to be cut in tough times.

I imagined that would probably already be in the forecasts, but things seem to have taken a further downturn in August in particular.

Have a listen to the System1 (SYS1) [I hold] AGM webinar on InvestorMeetCompany, it’s interesting and highly entertaining at times, especially when Maynard Paton read out a personal statement which rips into the Board, calling for their resignation. It certainly put the Chairman on the spot, and his responses were spirited & interesting I thought!). Cyclical recovery potential here maybe, and a whacking great net cash pile on its balance sheet, so I quite like it, AMBER/GREEN.

Similar company Ebiquity (EBQ) issued a PW on 23/9/2025, cutting forecasts. I’m less keen on this co, due to excessive debt. So I can’t get above AMBER – neutral.

M&C Saatchi (SAA) – issued weak H1 results on 18/9/2025, including particularly bad trading in Australia. SAA normally seems to ride out tough macro better than other marketing companies. At the moment I can’t get above AMBER, as I’m wondering if it might have scope for another PW at some stage? Some weird things on the balance sheet too. So we’re just neutral here, at AMBER.

The Mission Group (TMG) – in line results, so no profit warning, but did mention H2 weighting is usual, and it mentions some client delays, but a good pipeline. I’m sitting on the fence with TMG shares, as there’s too much debt on the balance sheet, and the group doesn’t add any value, so sum-of-the-parts might be a better outcome here for shareholders? (breaking it up & selling off the 4 agencies, but it’s hardly a good time to be considering that). Forget the forecast big divi yield, as high debt means that’s likely to be canx I think.

Make-up

Make-up is apparently a difficult sector.

Warpaint London (W7L) disappointed with a profit warning. My substack readers were critical of the company, and the timing of the PW, so I reached out to W7L and invited CEO Sam Bazini on for a podcast (behind the paywall I’m afraid) to give him a right to reply. I think he gave useful extra colour. The profit warning was mainly due to a UK customer going bust, and their largest customer (European) pausing orders to reduce inventories. I think shares have over-reacted on the downside, so bought some personally, hence I’m obviously biased (but still try to be objective). So an AMBER/GREEN for me.

Other profit warnings

Not covered above, look to be a mixture of contract delays from fundamentally high quality companies (e.g. PINE, SPSY [I hold].

The remainder look like basket cases, at the nanocap end of the market, which we have consistently been warning subscribers about with AMBER/RED or RED risk warnings all this year, including –

Tissue Regenix (TRX)- promising-sounding products, but has a big issue with excessive inventories and too much debt. So it clearly needs a refinancing, which has been obvious for some time – we rang the alarm bell at 59p on 30/1/2025. It’s now 11p. Could be a risky trade, who knows? I’d be most worried about dilution from another fundraise.

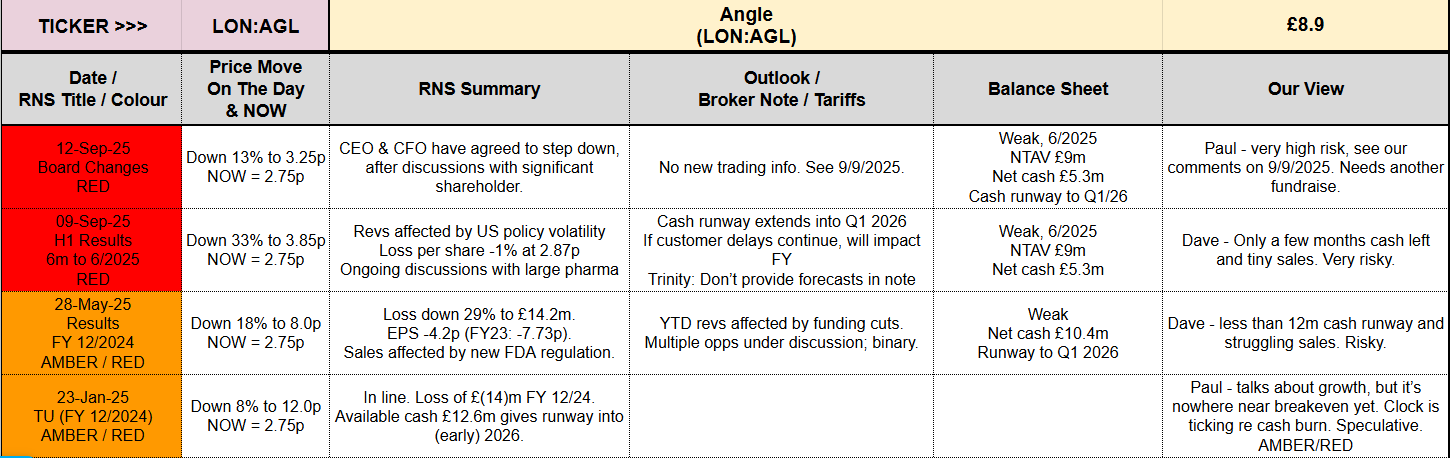

Angle (AGL) – we warned on cash burn, with AMBER/RED on 23/1/2025 at 12.0p. It’s now only 2.75p. Another disastrous cash-burning blue sky project. These things hardly ever work, so we’ll continue warning people away from story stocks that are not viable businesses. It’s been the biggest leak in my portfolio long-term, believing stories, and then watching the shares just wither away, and being too stubborn to throw in the towel – often actually compounding the losses by throwing new money after old.

Futura Medical (FUM) – almost out of cash, and its product doesn’t work. We’ve been warning punters away from this share for several years, after I “mystery shopped” Eroxon.

Look up Feature

Here’s an example of our lookup feature (spreadsheet that premium members have access to) which summarises all our commentary on any company (759 unique cos this calendar year) for a stock mentioned above, Angle (AGL) –

That’s it for this edition of The Small Cap View.

I hope you’ve found it useful or at least thought-provoking!

If you would like more of me and my team’s daily analysis, early-morning summaries and podcasts, why not take a free week’s trial of my Substack at paulypilot.substack.com and join a community of thousands of other investors.

See you next time and happy investing,

Paul Scott

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Nice summary Paul. I do subscribe to your substack and find it very enlightening and useful. Also some of your podcasts are hilarious. So for anyone reading this I would highly recommend PaulyPilot.

Paul has the merit of never talking down to anyone and his practical and patient presentations on the workings of Sharescope finally persuaded me to sign up after several failed efforts to understand the technology. I am very grateful for this as Sharescope is now an essential daily reference point for me. I would just add that his Substack account is I believe, the best value on offer by far in terms of the evaluation of company accounts and his daily Podcasts are a delight mixing deep knowledge with a very diverting personality.

I also subscribe to Paul’s Substack and the amount of content is amazing covering over 700 companies. His team of writers and his personal podcasts are so invaluable as well as entertaining and easy to understand, that I would urge anyone interested in UK small caps to give it a go and sign up for a free trial. Keep up the great work and looking forward to your next Sharescope article. Where does he find the time!

Another happy subscriber to Paul’s Substack. I joined on day 1 and the content is just outstanding, with plenty of coverage and really good quick analysis of the company news. The colour coding system has helped me to organise my research, avoiding to waste time on reds or amber reds

A great and thought provoking article. I have followed you since your Stockopedia days and always find your commentary relevant and pertinent to me as a small cap investor, so thankyou. Just one note, System1 is ticker SYS1 (not SYS which is for SysGroup PLC)

Thank you Gareth – good spot! We have amended SYS to SYS1.

Another happy Paulypilot substack reader here. As Paul says, for my money I get thoughts/analysis from four experienced investors. He also values the input to the discussion from subscribers and I do find it gives depth to the numbers in the news. In particular some contribute a more or less regular skim of the daily RNS news (thanks “Mr.C”), very helpful!

i took Stocko for a while to access your thoughts and tried for a subscription to them only so was very happy to subscribe to your Substack.

I found the Sharescope article to be very good. Useful template for the future?

I am delighting in the tie-up with Sharescope (which I have been a subscriber to for about 15 years) and the excellent Paul Scott (and am also a paid up member of his substack)

Exciting times ahead..

Good to see Paul on Sharescope