An employee culture where ‘B teams don’t exist’ has helped Elixirr International become an IPO winner. Maynard Paton assesses the management consultancy’s positive progress, entrepreneurial boss, lucrative options and current valuation.

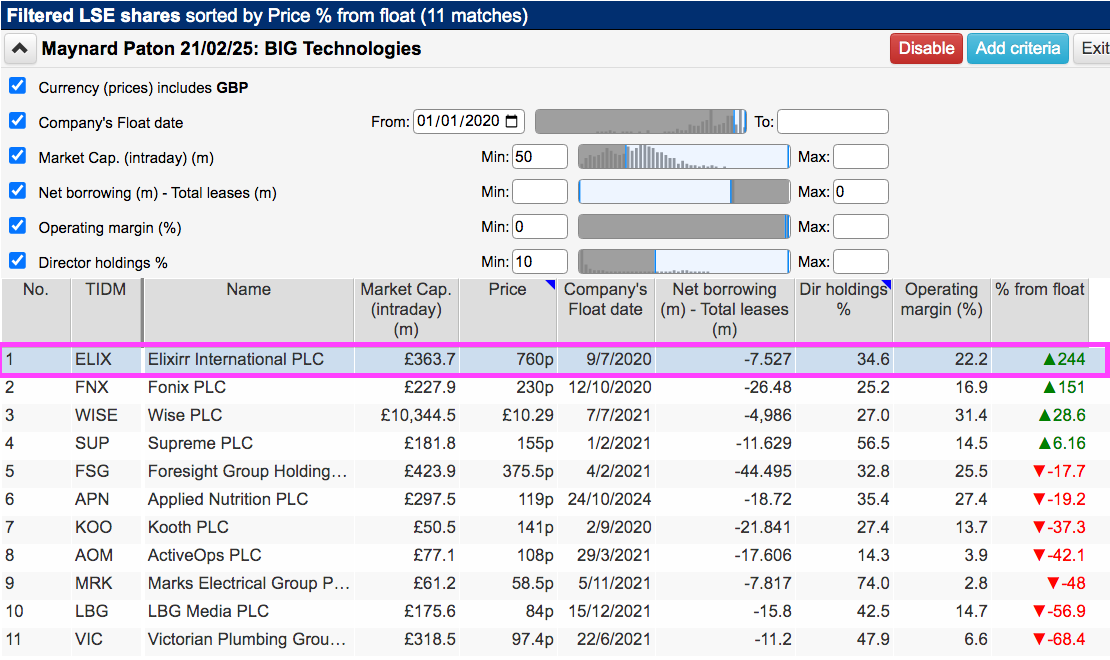

I remarked the other month how most flotations had suffered badly during the last few years.

ShareScope lists 233 shares that joined the stock market since the start of 2020, of which 178 (76%) currently trade below their listing price — including 72 that have lost 80% or more of their value.

I consequently devised a ShareScope screen to rummage through the IPO carnage to find potential buying opportunities.

I sought companies that had:

- Floated since the start of 2020;

- A market cap of more than £50 million;

- Net cash;

- A positive operating margin;

- Director holdings of 10% or more, and;

- A GBP-denominated share price.

When I first employed this screen I selected BIG Technologies, in part because of its then 49% post-IPO share-price slump. BIG’s shares then took a further tumble after firing its chief executive for misleading the board!

I therefore decided this time to study a flotation winner!

(You can run this screen for yourself by selecting the “Maynard Paton 21/02/25: BIG Technologies” filter within ShareScope’s excellent Filter Library. My instructions show you how.)

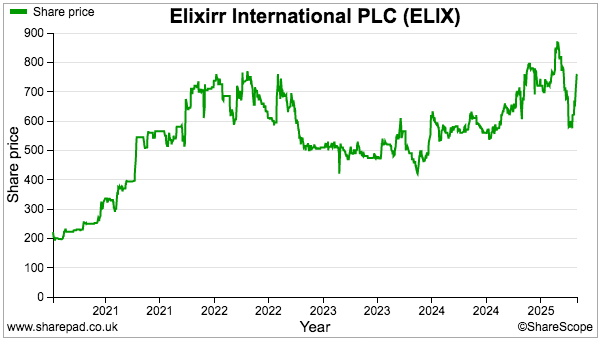

I selected Elixirr International entirely because of its impressive 244% post-IPO share-price gain.

Let’s take a closer look.

Introducing Elixirr International

“After leaving Accenture, having been in the consulting industry for nearly 30 years, I sat down and reflected on my time in the industry. My stance as a challenger and disrupter had made me realise that big consultancies had become stale and safe. The industry had become too politicised, driven by popularity votes.

True consultants are not politicians – they are leaders, they ask the difficult questions and don’t just comply with the narrative of the day. Looking at the weaknesses of the big firms, I wanted to build the best consultancy – one that prides itself on being forthright, honest and creating real dialogue that forms a view. “

So recounted Stephen Newton during this interview about why he established what became Elixirr International during 2009.

Teaming up with Accenture colleague Graham Busby — and receiving £300k funding from three friends — Mr Newton embarked on disrupting the likes of McKinsey, Bain and Boston Consulting and establishing “the best consultancy in the world”.

Elixirr’s early days were not easy. In fact, Mr Newton would later admit “the first three years were a question of survival“. But by 2012 Elixirr was recruiting new graduates, promoting employees to ‘partner’ status and doubling annual revenue.

Cultivating a ‘high-performance culture’ alongside lucrative option awards have since built the workforce to more than 500, with approximately 30 staff now appointed as partners and tasked with winning new business.

Elixirr’s services include the traditional strategic/operational consulting used by corporates that require outside assistance, although other support activities include ‘breakthrough imperatives’, ‘defining the C-Suite agenda’ and something called ‘executive immersions’.

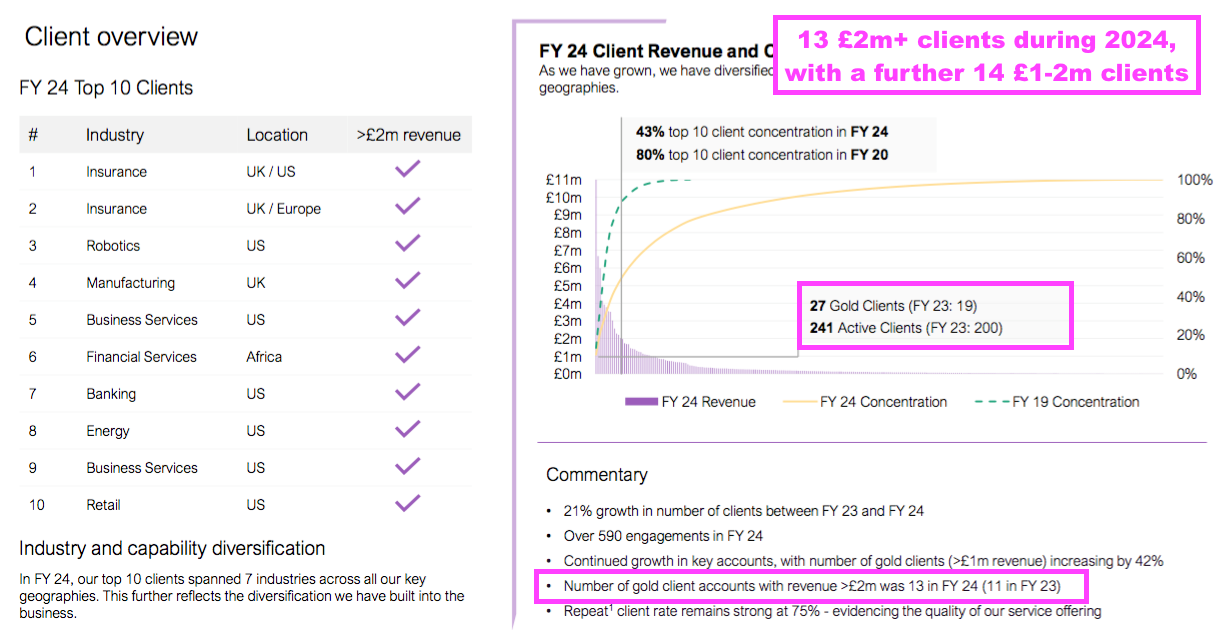

The services attracted 241 clients during 2024, and recent shareholder powerpoints have name-checked the likes of Allianz, Barclays, Chanel, Diageo, GSK, Hitachi, HSBC, LG, L’Oreal, LVMH and Mercedes-Benz. A commendable 75% or so of clients are ‘repeat’ customers in any given year.

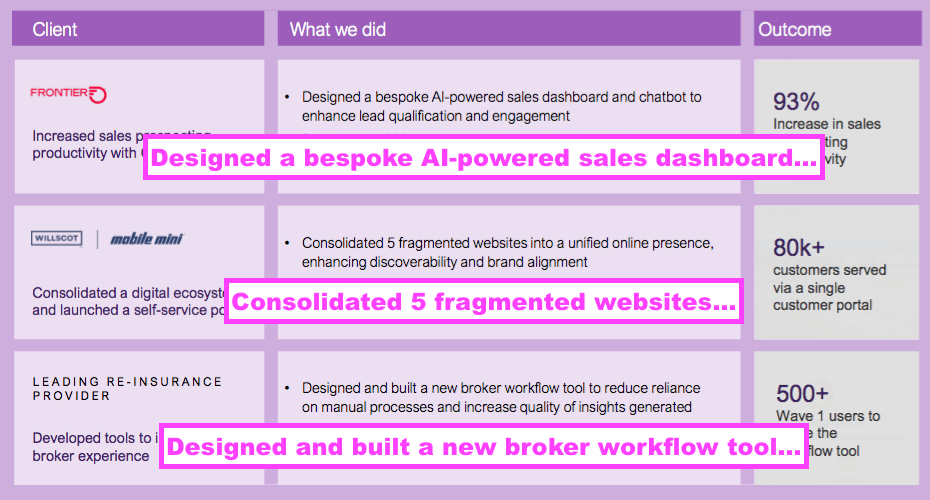

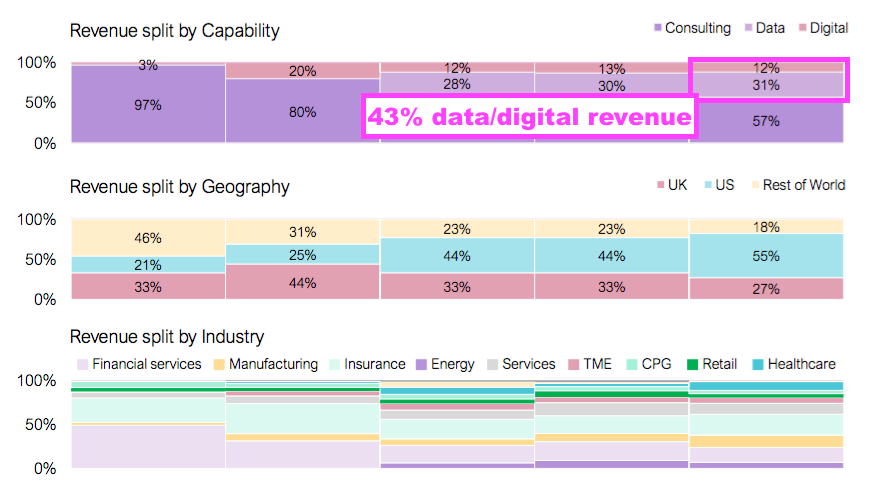

Following Elixirr’s 2020 flotation, six acquisitions have diversified the group into ‘data and digital’ projects. Mr Newton’s ambition for Elixirr has therefore been tweaked to “become the best digital, data and AI consulting firm in the world.”

The group’s workload now includes lots of software development…

…and such IT work represented 43% of 2024 revenue:

The acquisitions were:

- Coast Digital (digital marketing), purchased October 2020 for £5m;

- Retearn (procurement consulting), purchased April 2021 for £7m;

- iOLAP (data analytics), purchased March 2022 for £28m;

- Responsum (AI software), purchased September 2023 for £5m;

- Insignia (transformation consulting), purchased December 2023 for £13m, and;

- Hypothesis (insights research), purchased October 2024 for £28m.

The acquisitions also provided Elixirr greater exposure to the United States while broadening the client base beyond financial services and insurance.

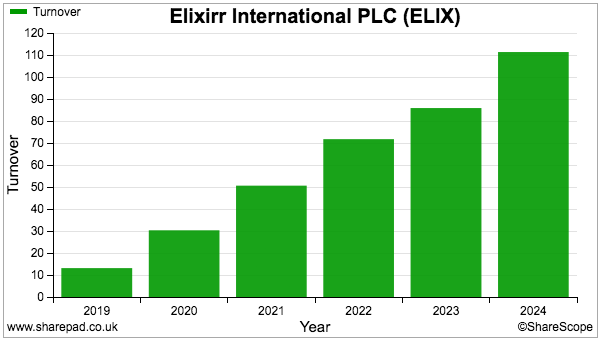

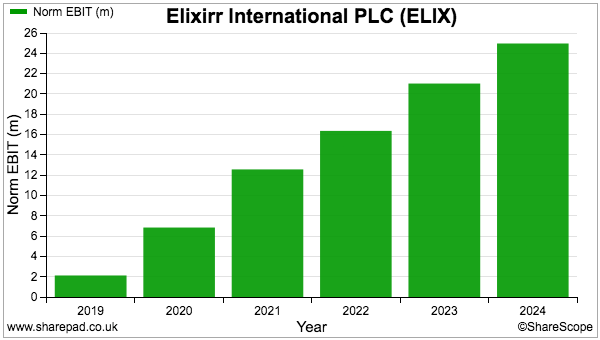

Elixirr’s headline financials since joining AIM have been impressive. Both revenue and profit have more than tripled, with the former reaching £111 million and the latter approaching £25 million:

The aforementioned 244% post-IPO share-price gain — from 217p to 760p — now supports a £364 million market cap:

Partner Productivity

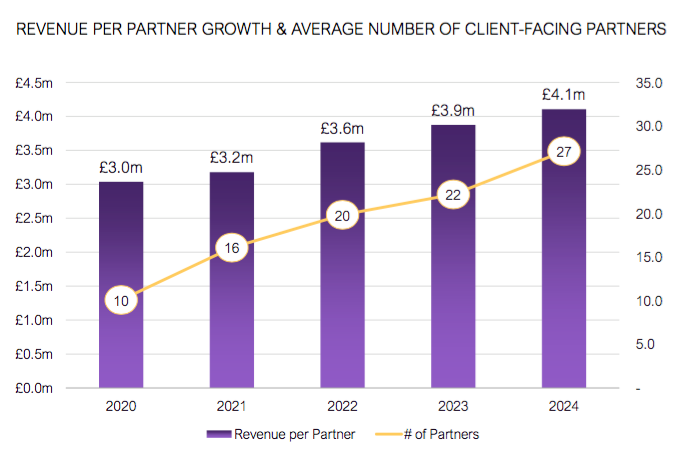

The chart below from Elixirr’s latest results explains why the market has warmed to these shares:

Annual revenue per partner has advanced from £3.0 million to £4.1 million, emphasising greater productivity from the group’s primary fee-earners.

Clients spending greater amounts have supported the enhanced partner productivity. Indeed, the group serviced 13 ‘gold’ customers paying £2 million or more during 2024…

…versus only one client paying more than £0.5 million during 2012, 14 paying more than £0.5m during 2019 and 17 paying more than £1 million during 2022.

Revenue per partner at £4.1 million may actually understate the group’s underlying productivity.

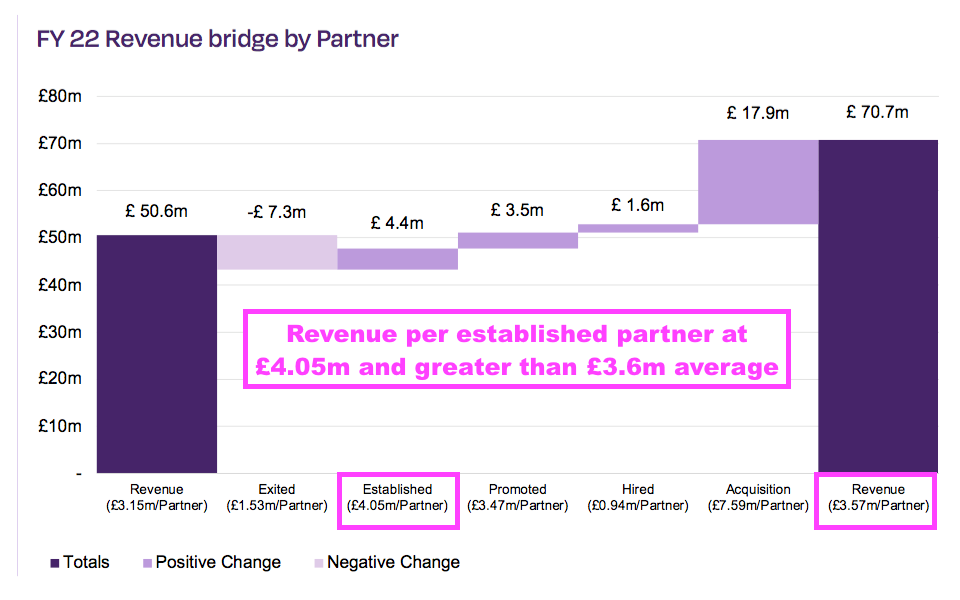

During 2022 for example, Elixirr’s established partners generated an average revenue of £4.05m, with the overall £3.6m average diluted by lower contributions from partners leaving the group and those newly promoted or hired:

Similarly for 2023, Elixirr’s established partners generated an average revenue of £4.8m, with the overall £3.9m average again diluted by partners leaving or joining:

Elixirr has not published the same ‘revenue bridge by partner’ chart for 2024, which is disappointing and hopefully not a sign of deteriorating partner productivity.

Several new partners have been appointed through acquisitions, and Mr Newton has in the past said buying businesses can be a more effective way to identify like-minded staff talent:

“Loyalty, teamwork and a strong work ethic are key differentiators – you need people who are committed to being on that journey. It’s critical to think carefully about where to find these people. Headhunters aren’t necessarily the right route as they don’t always find the most hungry and entrepreneurial people. It’s better to look at other firms that embody similar values to yours and then acquire those companies.”

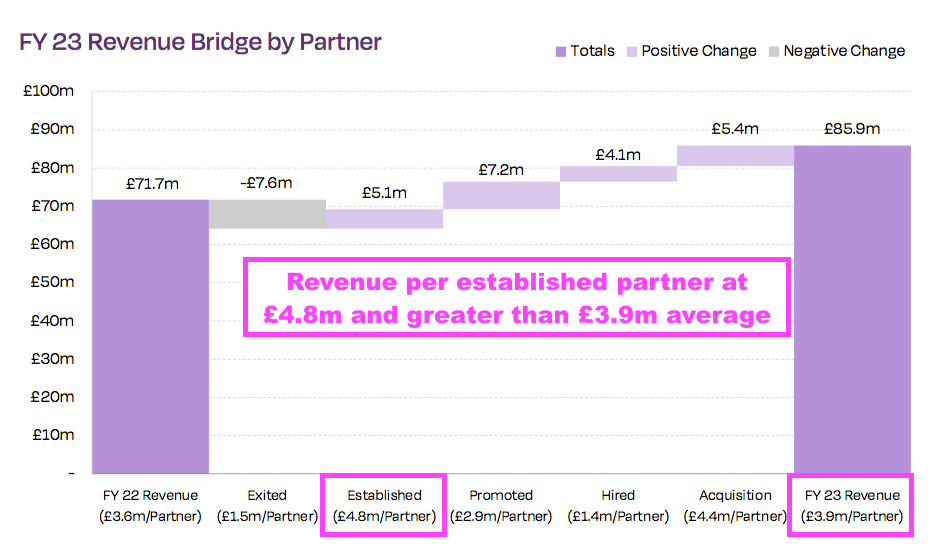

While partner productivity has been increasing, ShareScope’s revenue per employee stats imply general workforce productivity has not really improved:

Partner payments

Mr Newton described Elixirr’s “ownership mindset” during the latest results webinar:

“We’re a high-performance business. We expect high performance from our people. We reward them very well with equity. We make them owners.

We’ve got this belief that if you rent a house, you don’t care about it nearly as much as if you own it. And so all our employees are owners and all our partners are owners.

And we stand side by side with any financial investor in that ownership mindset. So we operate as if we own the business… And we hold all our partners to account to their individual P&Ls right down to the EBITDA that adds up to the EBITDA we report to you today.”

The “ownership mindset” among staff appears vital for investors. After all, many quoted businesses do seem to be run for the benefit of their high-earning employees rather than their shareholders.

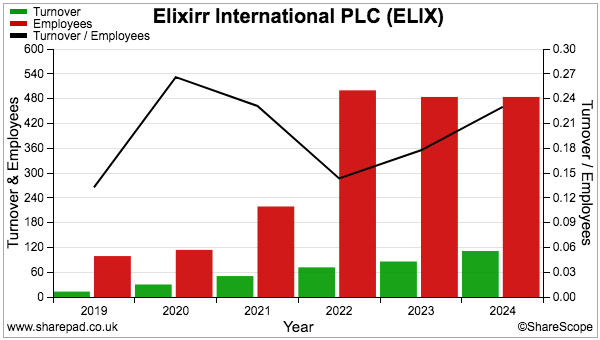

This slide from the latest results is very informative:

Elixirr claims its current partner package, “taken from IPO to today“, would have delivered £10.1 million in less than 5 years.

The slide’s small print says the partner package consists of:

- A £500k loan for shares;

- £3 million market-priced options, and;

- £400k annual remuneration (£200k salary plus up to £200k bonus).

All newly appointed partners receive an interest-free £500k loan from Elixirr that must be invested in Elixirr’s shares. They also receive options worth £3 million granted at the prevailing share price.

The total £3.5 million equity exposure then multiplied by the post-IPO share-price advance gives an £8.1 million gain over five years. Add on five years of salaries and bonuses then get the partner to £10.1 million…

…which compares to a five-year £5 million total salary and bonus opportunity at the likes of McKinsey and Bain.

Elixirr’s progress to date shows the partner packages clearly working. But incentivising partners could prove more difficult if, for some reason, the share price falters, the options prove less valuable and the bumper pay at McKinsey and Bain became much more attractive.

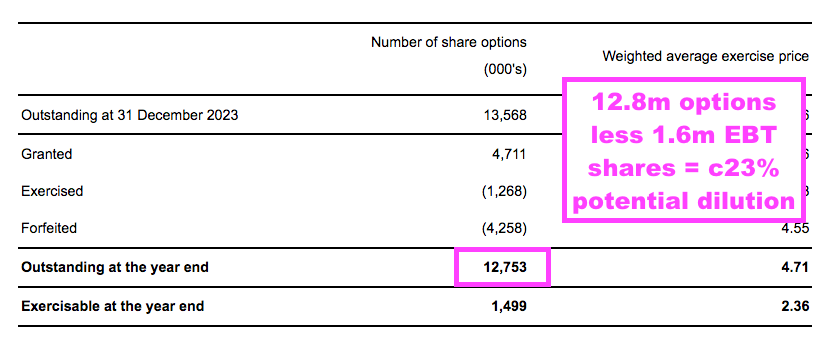

Elixirr’s 2024 results confirmed that 12.8 million options were outstanding with an average exercise price of 471p, which would be worth a net £37 million were they all exercised at the recent 760p share price. Adjusting for the 1.6 million shares held by the employee benefit trust (EBT), all the options would increase the current 48.2 million share count by a mighty 23%:

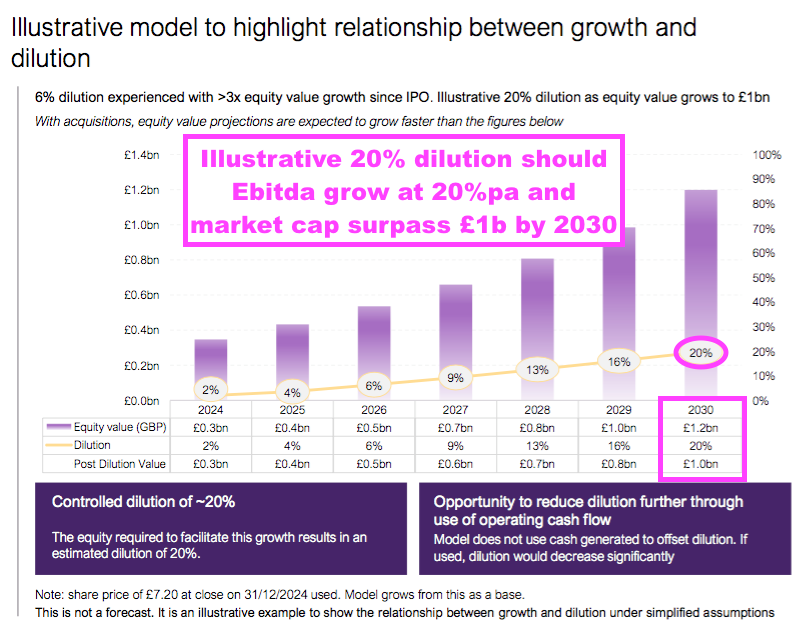

Not all options will convert into shares of course, as some partners will fail to meet their targets and/or leave before their options vest. In fact, Elixirr claims dilution could be 20% if the business grows by 20% a year and triples its market cap by 2030:

Margin, cash flow and ROE

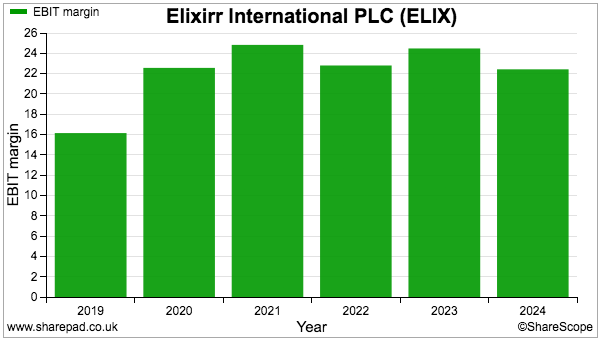

Elixirr’s operating margin has consistently topped 20% following the flotation:

This healthy conversion of revenue into profit does suggest this business is run with shareholders in mind.

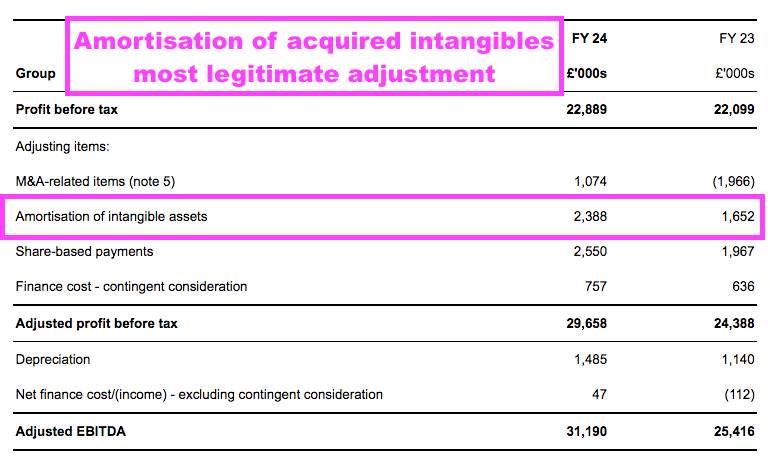

Elixirr presents an adjusted profit calculation, and adjusting only for the amortisation of acquired intangibles would improve margins by a useful two or three percentage points:

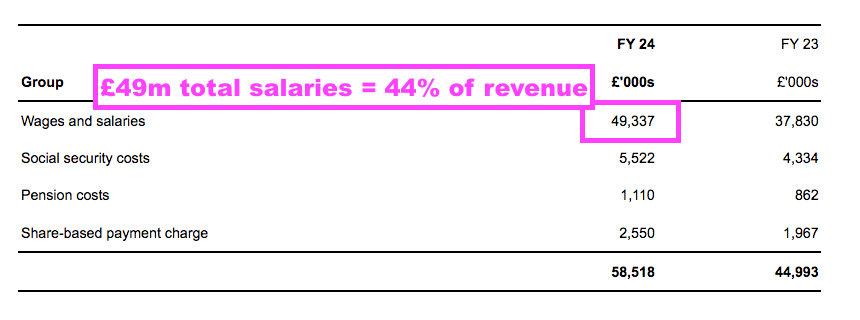

Elixirr’s largest expense is of course the workforce, and last year’s total salaries and bonuses came to £49 million — equivalent to 44% of revenue or approximately £87k per head:

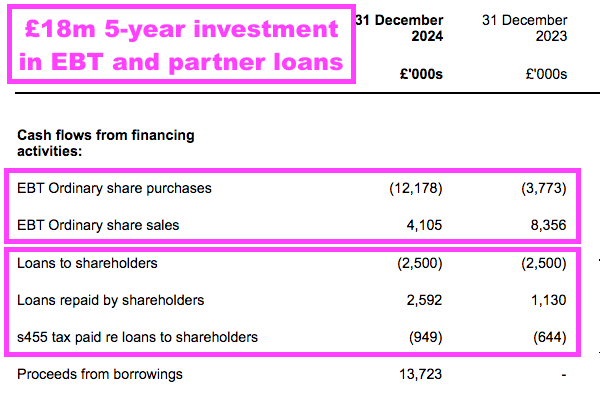

Note that certain staff ‘expenses’ are not charged against earnings. The cash flow statement reveals sizeable cash entries concerning the EBT and loans to shareholders:

These movements relate to staff options and the aforementioned £500k loans to partners and have amounted to an aggregate £18 million investment during the last five years.

This £18 million investment seems an inherent part of running the business and should really be included in Elixirr’s free cash flow calculation. If it was included, five-year free cash flow would have been reduced by 21% to approximately £65 million.

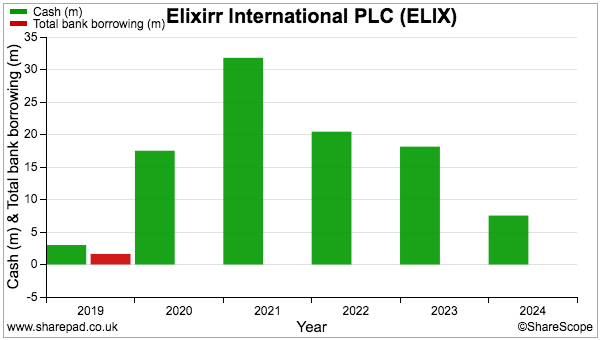

Elixirr’s net cash position has shrunk from more than £31 million to less than £8 million as the group bought shares for the EBT and spent close to £60 million on the aforementioned acquisitions:

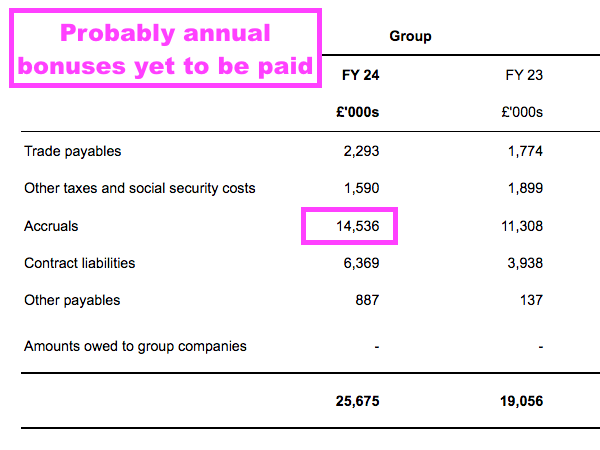

The 2024 net cash position is not ‘surplus money’, but instead reflects. expenses incurred but yet to be paid (‘accruals’) of nearly £15 million…

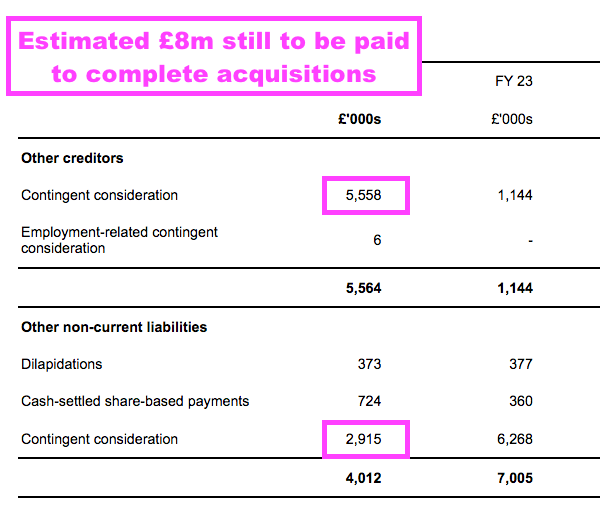

…and having yet to pay an estimated £8 million to complete past acquisitions:

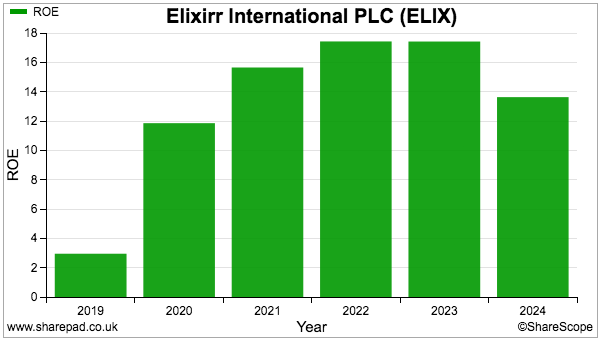

Elixirr’s return on equity (ROE) reduced to 14% last year following the latest acquisition:

A 14% ROE seems about right given the significant acquisition activity, whereby the larger iOLAP and Hypothesis purchases were conducted on EBITDA multiples of 6-9x which probably translates into immediate earnings returns of 10-15%.

Elixirr hopes to undertake “one or two” acquisitions a year that by themselves will lift annual EBITDA by 10-20%. With EBITDA last year at £31 million, yearly acquisition expenditure might have to expand towards £50 million to meet that 10-20% growth ambition.

Elixirr claims its acquisitions have produced extra cross-selling revenue of £44 million, and my very rough sums suggest acquisitions have added revenue of £49 million and organic growth has added revenue of £32 million since the flotation.

Boardroom

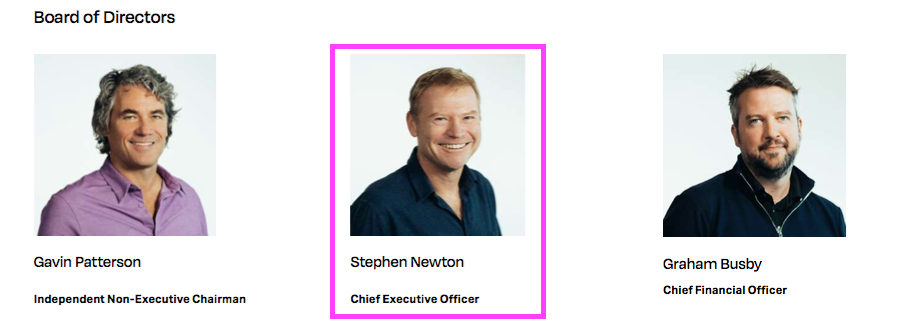

Mr Newton remains on Elixirr’s board as chief executive:

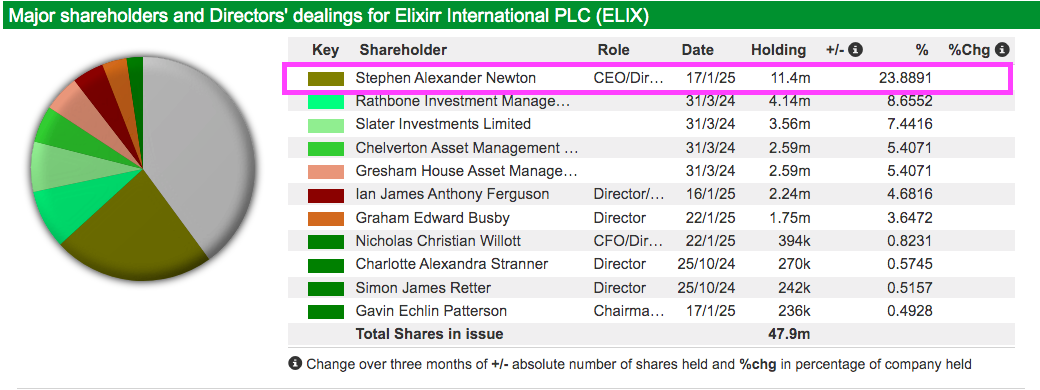

Mr Newton exhibits an “ownership mindset” through a 24%/£87 million shareholding:

Mr Newton is accompanied on the board by his Accenture colleague Graham Busby, who retains a 4%/£13 million stake and moved from finance director to deputy chief executive at the start of 2025.

Appointing a deputy chief executive suggests Mr Newton has commendably planned ahead for his succession. Note that Mr Busby is 42 years old and 12 years younger than Mr Newton.

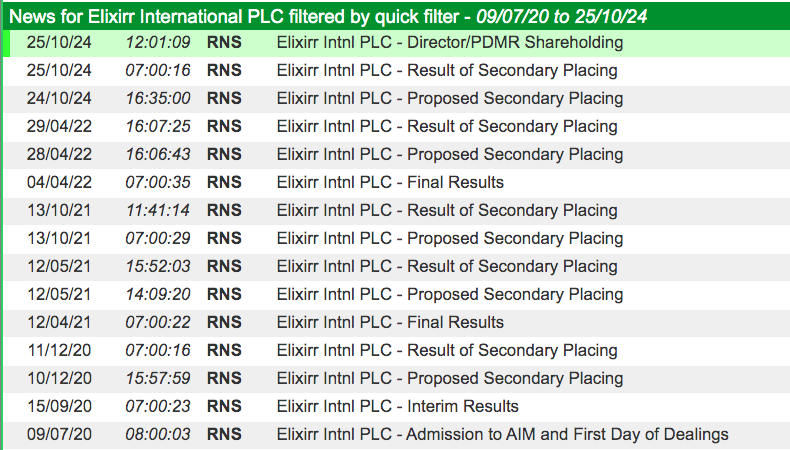

ShareScope reveals Elixirr has undertaken five secondary placings that allowed the directors to reduce their shareholdings:

Although the group’s progress to date does not suggest the placings have an ominous motive, director selling is not ideal for partners who are building their own stakes through options and loans.

Following the flotation, Mr Newton has raised almost £21 million after reducing his shareholding by 24% at an average of 587p.

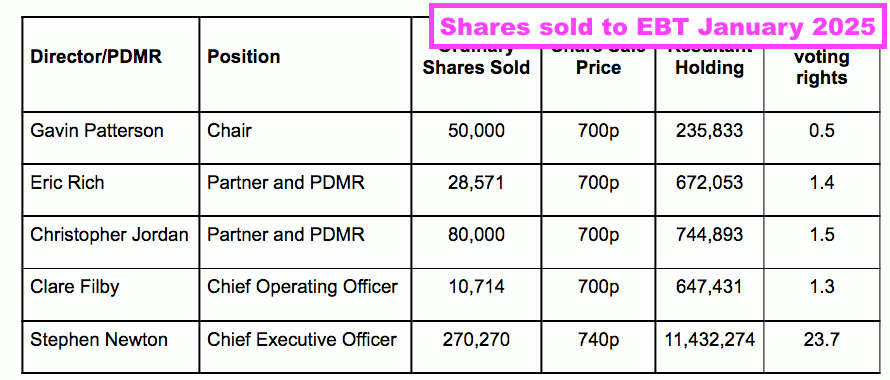

Note that Mr Newton and other board members have occasionally sold shares to Elixirr’s EBT:

I am not sure whether a conflict of interest arises when directors authorise company money to purchase their own shares.

Mr Newton’s £315k basic salary for 2023 did not appear extravagant versus the group’s then £20 million profitability, while shareholders that have enjoyed the 244% post-IPO share-price gain are unlikely to object to his £1 million-plus annual bonuses.

Shareholders may however quibble with the group’s AGM location. Previously held at the group’s City office, the event was last year hosted at a five-star country hotel a few miles from Winchester at 9am.

Valuation and summary

Published last month, Elixirr’s 2024 results revealed plans to move from AIM to the main market. The group claimed the transfer would “unlock access to broader institutional capital and, over time, potential index inclusion — benefitting shareholders and supporting long-term growth“.

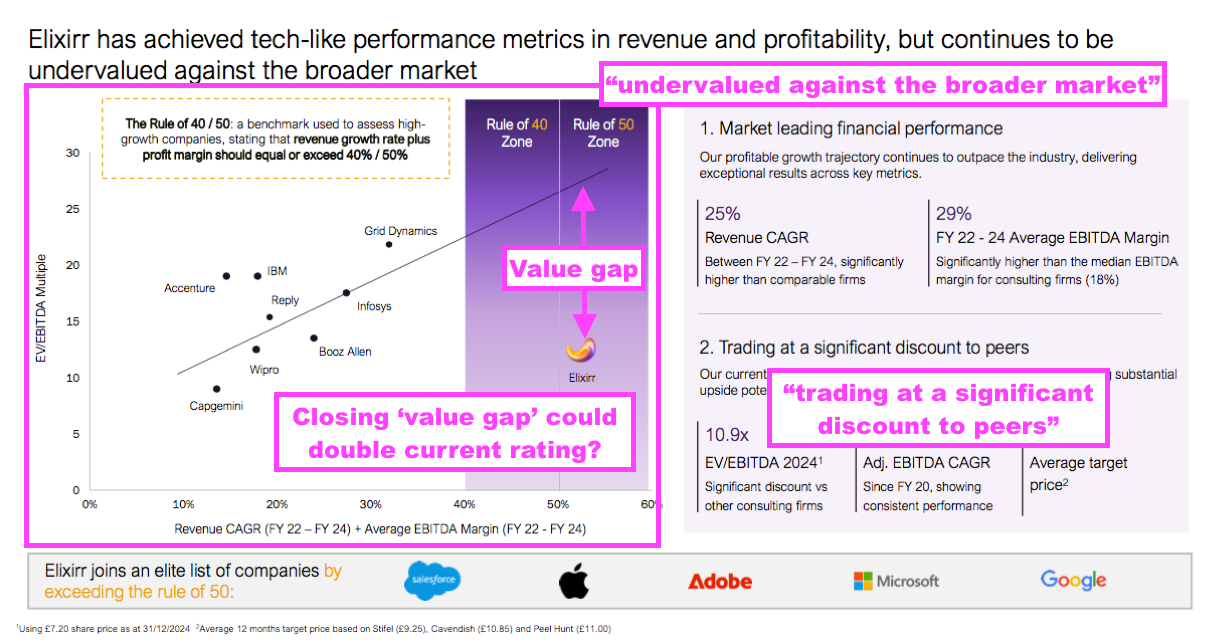

The 2024 presentation even stressed the shares were “undervalued against the broader market“:

Citing a three-year 25% revenue CAGR and a three-year 29% average EBITDA margin, Elixirr claimed its valuation — based on the ratings of larger consultancies — should actually be double the recent multiple.

I am never convinced by management teams that tout how “undervalued” their shares are. And I am less convinced when the same directors have been regular sellers through secondary placings.

I do wonder whether Elixirr must always ‘hard sell’ the investment upside to ensure the group’s option packages remain lucrative and so retain new partners. After all, if the share price just goes sideways, any option gains may become dwarfed by the bumper pay and bonuses at McKinsey and Bain.

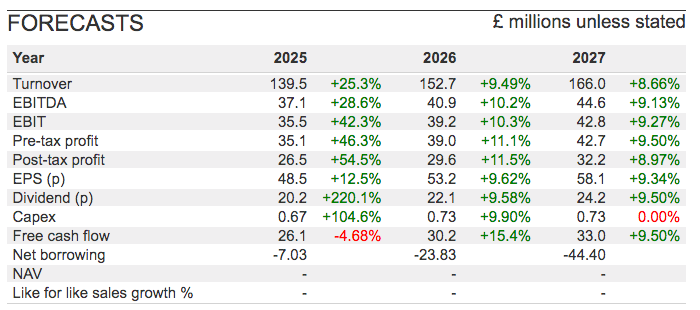

ShareScope offers the following consensus forecasts:

The 10% growth estimates for 2026 and 2027 seem very plausible given Elixirr’s recent progress. I get the impression the estimates do not assume further acquisitions.

The 760p shares trade at 13x projected 2027 earnings, which does not seem outlandish given the progress to date. But do bear in mind that reported profits do not reflect the cash absorbed by the EBT and partner loans.

Can Elixirr achieve the City’s projections and even close the valuation gap to those larger consultancies? Everything seems dependent on the performance of the partners and whether they can push their average revenue towards £5 million and beyond.

If they can, then Elixirr’s momentum should continue as a share-price re-rating leads to greater partner wealth that in turn persuades further top-notch consultants to sign up.

But if revenue per partner flounders, I fear the share price may struggle and doubts will then emerge about the option-package incentive model. There may be good reasons why rivals such as McKinsey and Bain choose to operate as private companies.

But something I am quite certain about is Mr Newton doing his utmost to weed out the parters not pulling their weight. I suspect many IPO disappointers of the last few years could learn from Elixirr’s refreshing employee culture, in which “‘B teams’ don’t exist“:

“The culture and model we’ve created across our firm is one our competition simply cannot mimic or reproduce. But I hope what we have created sets the bar for the future of consulting. One where mediocre isn’t acceptable. One where ‘B teams’ don’t exist. And one that truly helps set businesses apart.

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Elixirr International.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.