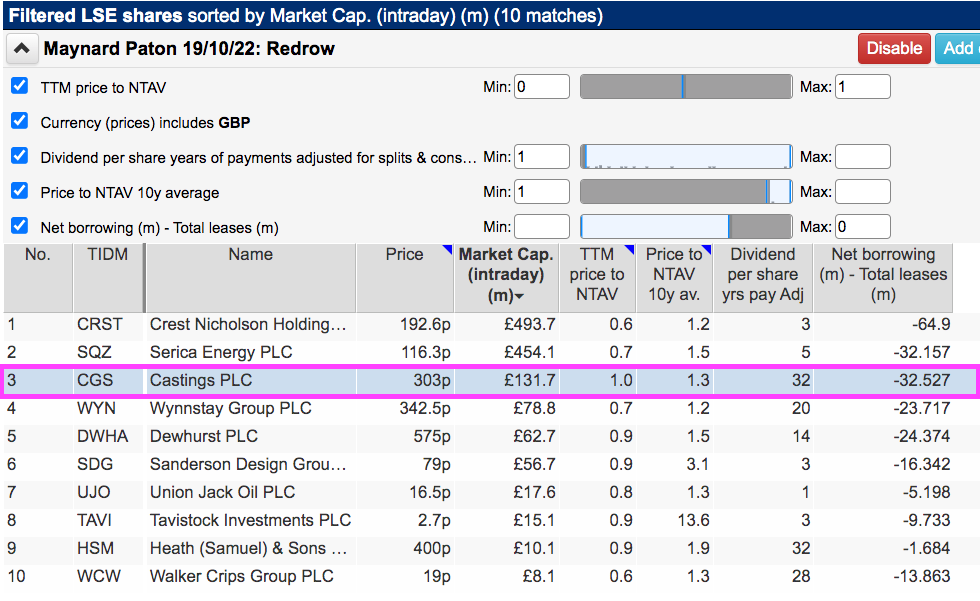

A liking for ‘value bargains’ prompts Maynard Paton to search again for asset-rich shares with depressed ratings. Screening for low price to books and net cash positions leads to engineer Castings.

I always love a traditional ‘value bargain’. Hence this revisit to an old screen that pinpoints companies trading at less than book value.

Importantly, this screen attempts to avoid ‘value traps’ by demanding the shares carry net cash, pay a dividend and offer a history of trading above book value.

The exact filter criteria I redeployed were:

- A price to net tangible assets of no more than 1;

- A dividend being paid during the most recent year;

- A 10-year average price to net tangible assets of at least 1;

- Net borrowings less total leases of no more than 0 (i.e. a net cash position excluding IFRS 16 lease obligations), and;

- A share price denominated in pounds sterling.

SharePad returned 10 companies, and I selected Castings because I used to own the shares and was surprised to discover the company was on the list:

(You can run this screen for yourself by selecting the “Maynard Paton 19/10/22: Redrow” filter within SharePad’s comprehensive Filter Library. My instructions show you how.)

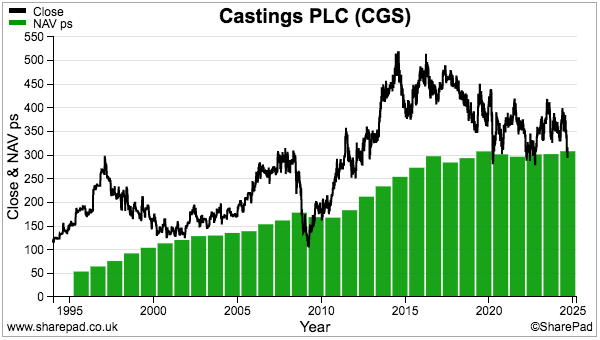

Sure enough, Castings’ 303p shares trade (just) below the group’s 308p per share net asset value:

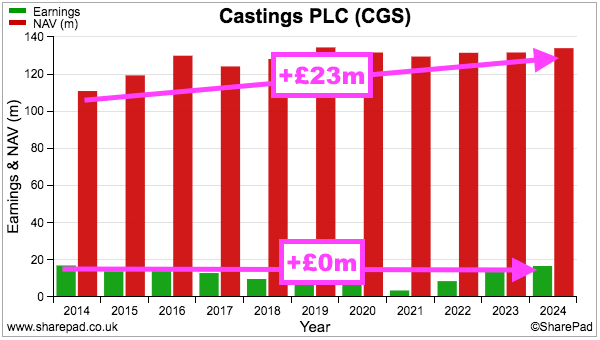

My filter results indicated the shares have traded at an average of 1.3x book value during the last ten years, while the SharePad chart above shows the rating stretching to 2x during 2014.

But there has been the odd occasion (such as now!) when the share price has fallen below book value.

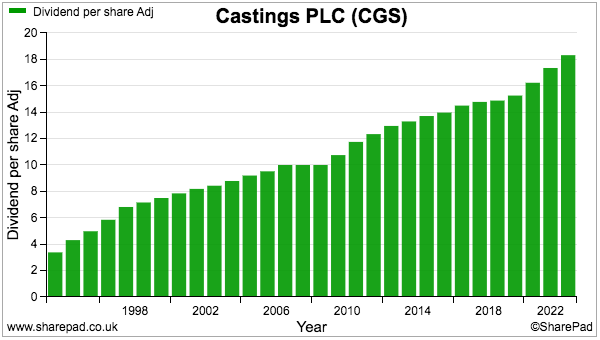

Castings’ book value has advanced over time, and so has the dividend. The payout has in fact not been cut for at least 30 years:

Special payments were also declared for 2016, 2019, 2022, 2023 and 2024.

Given the illustrious dividend history, Castings does not seem the type of business that should be selling just below book value. Yet the shares have moved sideways for years; the 303p price was first achieved in 2007 and today supports a £132m market cap.

Let’s take a closer look.

Introducing Castings

Castings was established as an iron foundry on Selborne Street in Walsall during 1835. The business was among a number of foundries in the Black Country that apparently manufactured rings, buckles and other items used for horse saddles, bridles and harnesses.

Later years would see orders from manufacturers of cars, motorbikes, trailers and tractors as the firm reportedly produced “high-quality castings in whiteheart and blackheart malleable iron“:

(Source: Graces Guide)

Castings moved to the Brownhills area of Walsall during the 1950s and today is best known for casting components for engines and chassis of heavy trucks. Customers are attracted by “rapid prototyping“, leading-edge manufacturing, “flexible, agile and cost-effective” processing and a policy of no minimum quantities.

This video provides an excellent showcase:

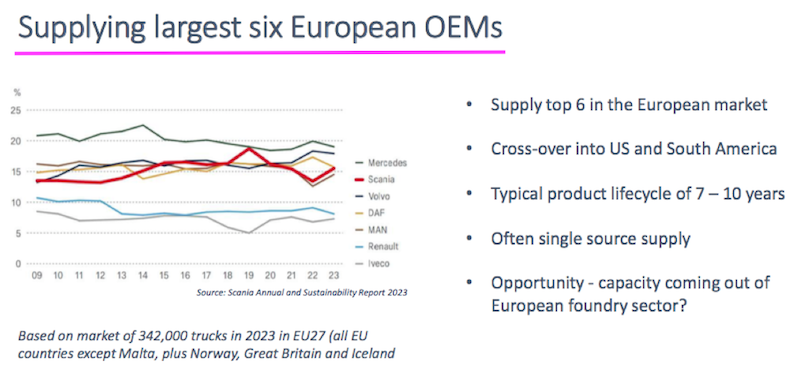

Orders are dominated by six of the seven large European truck manufacturers — Mercedes, Scania, Volvo, DAF, MAN, Renault and Iveco:

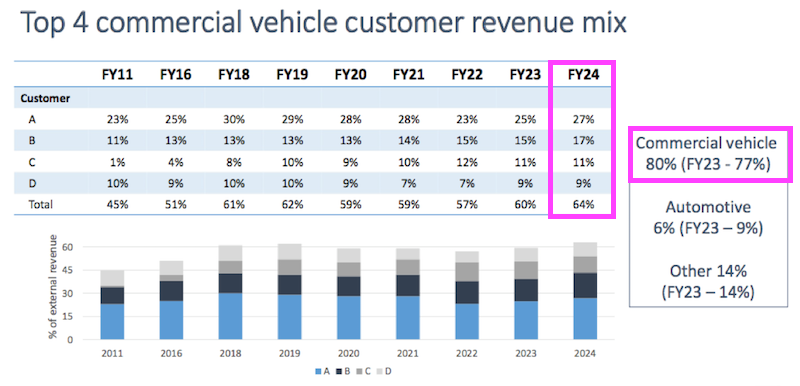

Last year these truck manufacturers supplied 80% of revenue, with 54% supported by only three customers — believed to be Scania, Volvo and DAF — and 27% supported by just one:

As hinted by the aforementioned dividend, Castings offers a reasonable financial history despite the customer concentration.

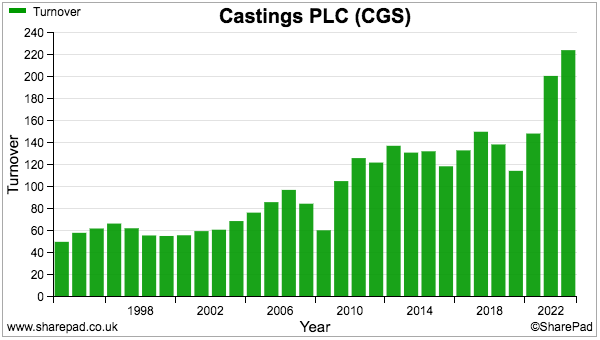

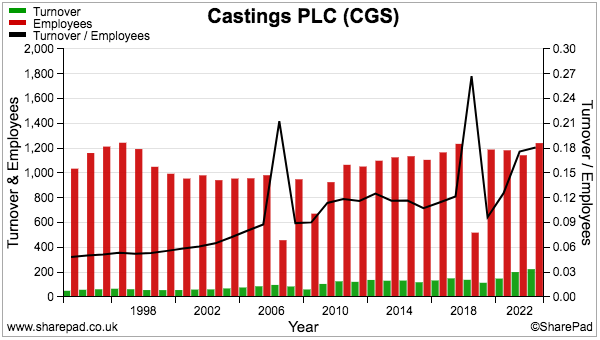

SharePad shows revenue advancing from £50 million to £224 million since the mid-1990s:

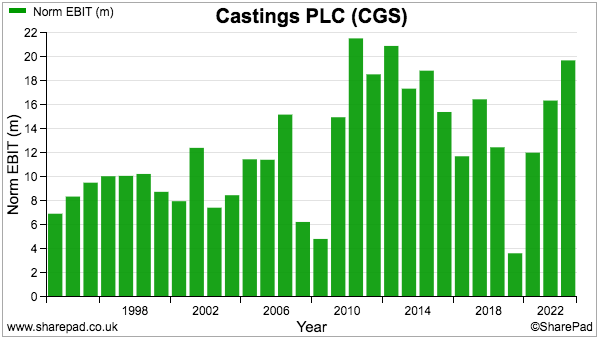

Operating profit has meanwhile suffered some sharp ups and downs — notably after the banking crash (2009/10) and pandemic (2021) — but has still climbed from £7 million to £20 million during the last 30 years:

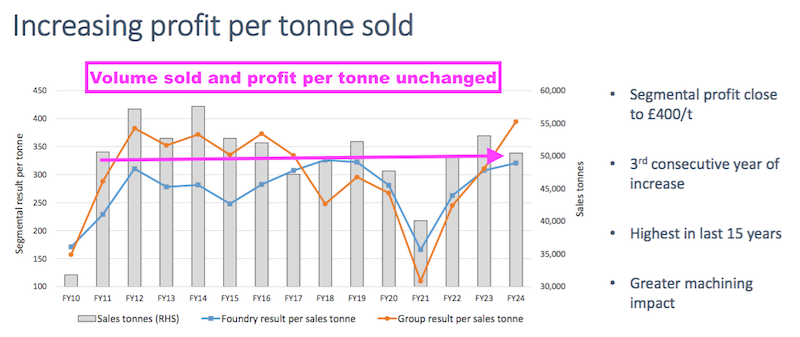

Despite the greater sales and profit, factory output has not dramatically improved. Last year the group sold 55,000 tonnes of castings — matching the average witnessed during the previous decade:

Profit per tonne of castings has rebounded since the pandemic lows but broadly matches the levels enjoyed between 2011 and 2019.

Maybe a new production line will help the group’s volume and create some economies of scale. The latest results confirmed £17 million being spent on an additional 15-20% of foundry capacity — the first such expansion since 2008.

Castings’ history encouragingly lacks significant acquisitions; the last such activity involved two small purchases during the early/mid-1990s.

And perhaps unsurprisingly for an operation that dates back to 1835, the accounts are refreshingly old-school. The balance sheet is free of intangibles, assets are entirely owned outright (no IFRS 16 leases!) while minimal ‘exceptionals’ interfere with reported earnings.

Castings floated during 1960 and Companies House suggests the business was not a spectacular performer during its early quoted life.

The 1985 annual report says the shares were 16p on 6 April 1965 and had increased to only 20p by 31 March 1982. The share-price CAGR during the subsequent 42 years is therefore almost 7% excluding reinvested dividends.

Balance sheet

Any potential book-value investment must start with the balance sheet. And Castings scores well with its assets.

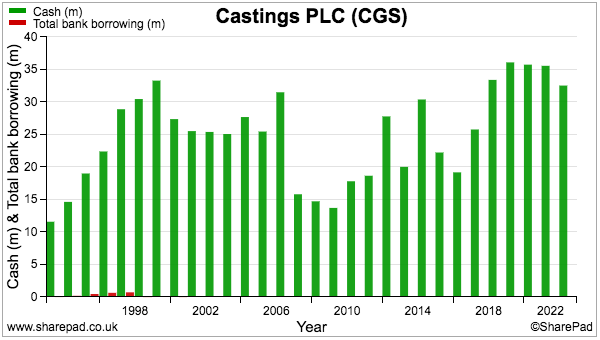

The group has consistently operated with a significant cash position and last possessed bank debt more than 20 years ago:

The last reported net cash of £33m equates to almost 25% of the market cap.

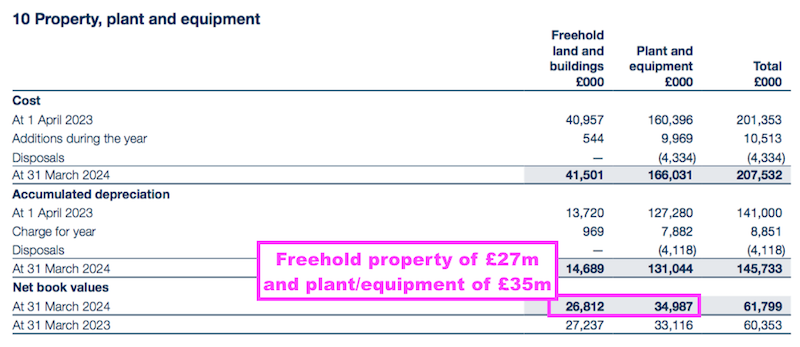

Alongside the cash is property, plant and equipment with a £62 million carrying value, which represents nearly 50% of the market cap:

Freehold land and buildings sport a £27 million value, although I suspect that figure significantly understates the true market value of the properties (annual reports from the 1990s claim the then market value of the freeholds was greater than their book value, but the expense of a revaluation could not be justified).

To be honest, I would not be surprised to learn these old-school accounts carry the Brownhills site at its 1950s cost price. For some perspective, the group has spent £36 million on freehold land and buildings during the last 30 years.

Whether the other plant and equipment is really worth £35 million is difficult to say.

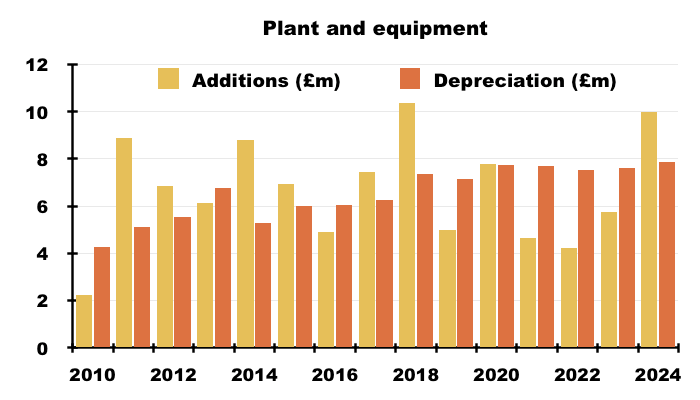

But I get the impression these assets are not ‘under-depreciated’ to enhance their balance-sheet value. I calculate aggregate expenditure on new plant and equipment during the last ten years has come to £67 million, while the associated depreciation charge against profit has come to £71 million:

The remaining 25% or so of the balance sheet comprises mostly working capital: stock of £33 million plus debtors of £47 million less creditors of £33 million.

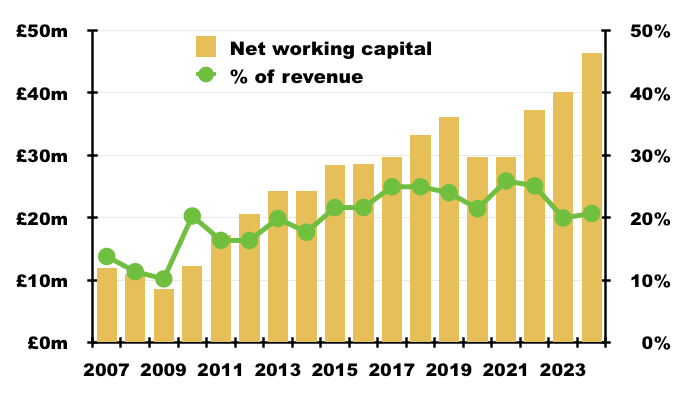

The net working-capital figure of £47 million is equivalent to 21% of revenue:

21% does not seem out of kilter with previous years and suggests the latest balance sheet is not temporarily flattered by excess stock and debtors.

I note the stock of £33 million includes provisions of only £811,000, which implies the work-in-progress exhibits a low risk of obsolescence. Customers seem likely to settle their invoices on time as well. Within trade debtors of £34 million, only £488,000 were deemed ‘past due’.

Boardroom and employees

Castings’ illustrious dividend most likely reflects a long-term ‘family’ influence.

Brian Cooke joined the company during 1960 after attending foundry college and worked initially as an engineering apprentice. Somewhat remarkably, he was appointed a director after just six years of employment at the age of 26.

Mr Cooke then became Castings’ lead executive during 1970 and relinquished his executive duties an incredible 45 years later. He was also the group’s chairman between 1983 and 2023.

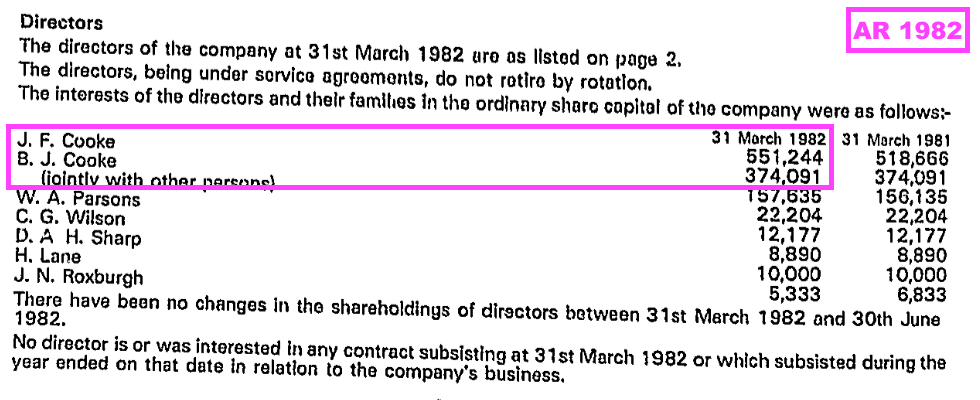

Mr Cooke’s fast-track journey from apprentice to director almost certainly stems from John Cooke, who I presume was Brian’s father. John Cooke owned 8% of the company before handing over the chairmanship to Brian during 1983:

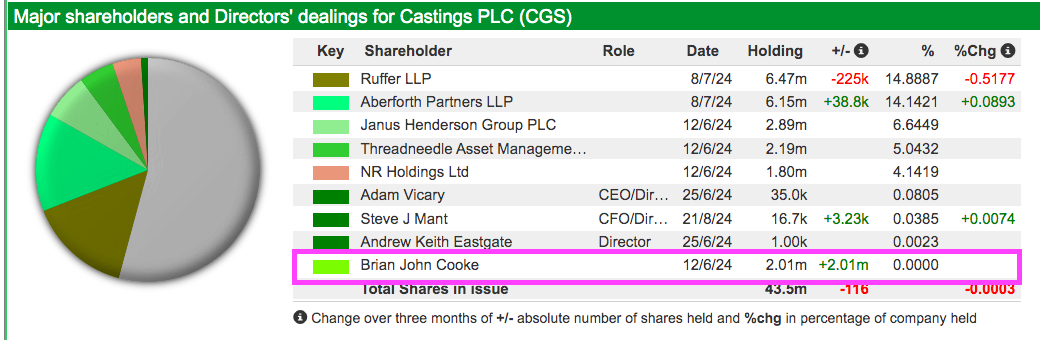

Brian Cooke owned nearly 6% of Castings when he became chairman and still retains a near-5% holding despite leaving the board last year:

The current chief executive took on the top job during 2017 after joining the group seven years earlier. The new boss is not a Cooke family member, but has exhibited Cooke-like behaviour; the group’s dividend has kept advancing, substantial cash has been retained on the balance sheet while special dividends have taken precedence over fanciful M&A.

I am reassured the chief exec has a degree in metallurgy and his entire career has involved the foundry industry — especially as every other director is either an accountant or solicitor!

The board’s shareholdings are minimal and management has become more ‘professional’ since Brian Cooke’s day. Results RNSs are no longer terse affairs published entirely in uppercase at 9am with no City engagement; these days the figures are even accompanied by presentations and webinars.

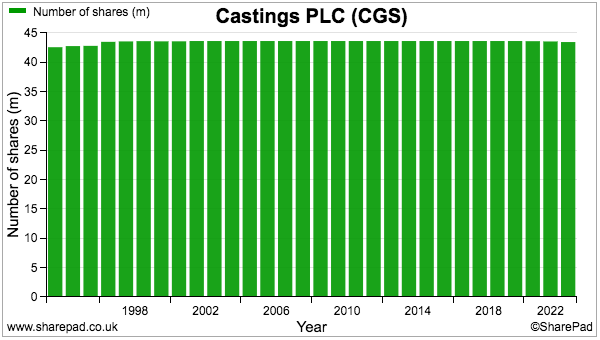

Executive options have also made a re-appearance following a c.20-year hiatus from the remuneration report. Mind you, the share count has remained commendably flat over the last few decades:

An encouraging feature of Castings’ leadership is the ongoing improvements to workforce productivity. Overlook the couple of gremlins within SharePad’s employee data, and rising revenue per employee suggests consistent advances to manufacturing efficiency:

Industrial engineering and shift work is not for everyone, though, as annual staff turnover of 20%, 17%, 21%, 19% and 16% has been reported since 2020. The business is also unlikely to win any diversity prizes with a 91% male workforce.

Margin, ROE and current trading

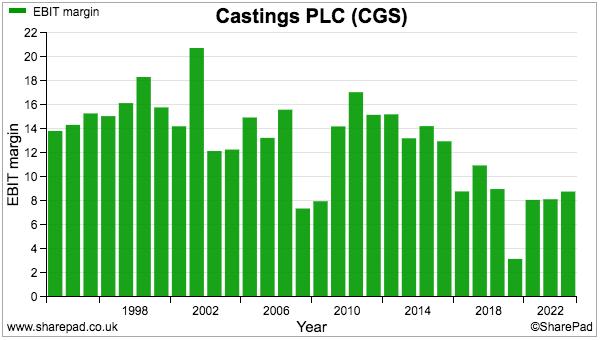

Greater workforce productivity has sadly been unable to support Castings’ margin. For years the group used to convert a respectable double-digit percentage of revenue into profit:

But the margin trend has been downwards since 2012 and the 8-9% reported during the last few years suggests the group’s competitive edge has waned.

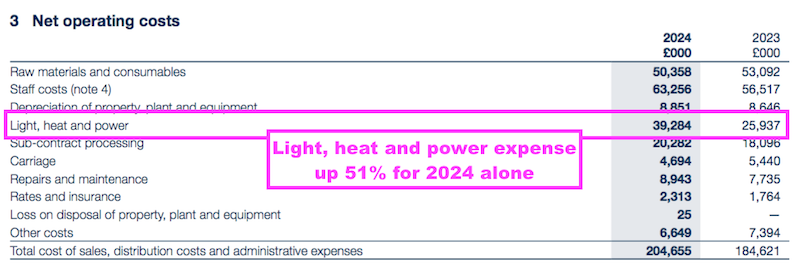

Castings has certainly been hurt by greater energy charges. Last year the group’s factories consumed 159 million KWh of gas and electricity at a total cost of £39 million — equivalent to 18% of revenue:

For comparison, energy costs absorbed just 8% of revenue during 2020 — since when my estimated cost per kWh for Castings has tripled.

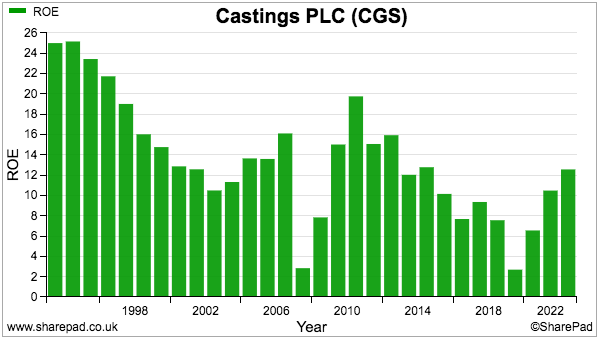

Castings’ return on equity (ROE) was a modest 12% for 2024 and has not set pulses racing for at least a decade:

The mighty cash pile — and the lack of interest received until recently — has arguably depressed ROE. But then again, any freeholds in the books at yesteryear prices ought to bolster the calculation.

The SharePad chart below is very sobering. Earnings for 2024 were the same as for 2014, while net assets have increased by £23 million:

Retaining an extra £23 million in the business for no additional earnings over ten years probably explains why the stock market has become more circumspect about the valuation.

Another good reason for the lowly share price is the struggling order book. Last month’s AGM heralded a profit warning:

“Demand has remained at lower levels and our customers have now indicated that there is unlikely to be any improvement before at least early 2025. The OEMs are citing caution in the end customer buying decisions, particularly in Europe. In the light of this, the result for the full year to 31 March 2025 is anticipated to be below market expectations.”

This warning worryingly coincides with that aforementioned £17 million expenditure to expand capacity by 15-20%. The new production line should be running by mid-2025, although when will customers supply sufficient orders to justify the investment is not clear.

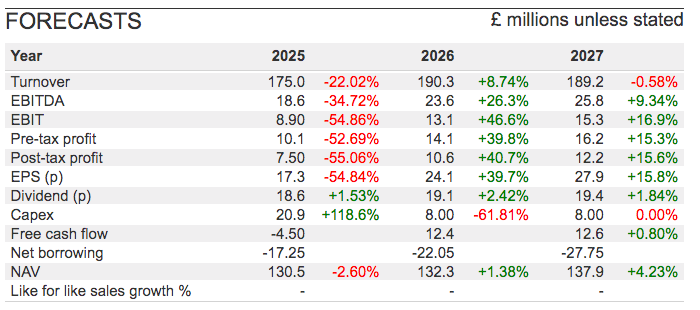

Brokers have translated the warning into the following estimates:

2025 earnings are projected to leave the dividend slightly uncovered, which in turn, reduces the expected net asset value a fraction. But a profit rebound delivering modest dividend and net asset progress is predicted thereafter.

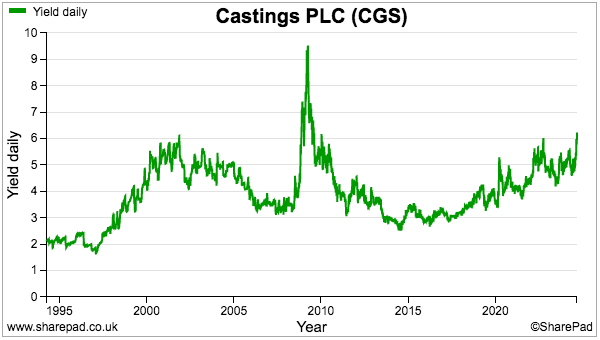

The yield at 6% is the highest since the banking crash:

Summary

For what it is worth, I bought Castings during 2015 at 426p because of the dividend, cash, Brian Cooke and lack of M&A. I then collected payouts totalling 76p per share and sold at 343p during 2019 — leading to a 2% loss over four years.

I sold after belatedly realising the shares would never attract a much higher rating unless margins and ROE improved. Five years later, the margin has weakened, ROE remains modest and the share price has fallen further. Brain Cooke has also left.

During my time as a shareholder, the shares never traded below book value. But now they do, and I would like to think these genuine asset-flush accounts offer minimal downside as greater orders from European truckers are awaited.

But when exactly those greater orders will appear is hard to predict, and I suspect returns in the meantime may be restricted to that 6% income.

Indeed, despite my SharePad screen telling me otherwise, this share does emit a ‘value trap’ vibe. The inherent economics of the business at best stagnated during my four years as a shareholder and the five years after that.

Production volumes and profit per tonne not improving certainly says something about the competitive pressures this business must face. And I would hate to imagine Castings retains another £23 million for no extra earnings over the next ten years.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Castings.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.