Obscure small-cap Colefax has repurchased 75% of its share count since 1999. Maynard Paton weighs up the fabric designer’s impressive buyback record and cash-rich financials versus its modest growth history and awkward corporate governance.

The email I received was intriguing:

“The numbers speak for themselves. The company has repurchased 75% of shares outstanding since 1999, has a decent return on equity (last financial year approximately 18%), and is trading at an EV/EBITDA of 3-4 due to £20m net cash on the balance sheet.

The market has either overlooked the stock entirely or is pricing in profits falling off a cliff, which I don’t see happening given the maximum decline of 40% after the GFC. I’d love to know what you think.”

The company in question is Colefax, a small-cap so obscure that even I — a keen investor for 30 years — had previously never heard of.

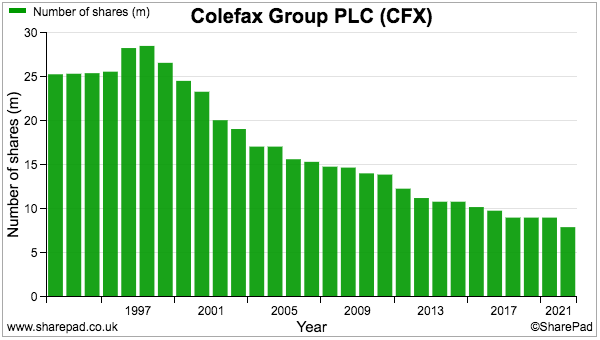

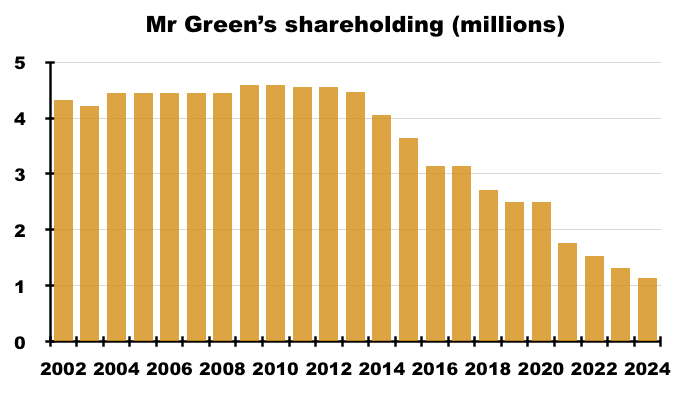

But any business that has bought back 75% of its shares must be worthy of further investigation. Sure enough, Colefax’s share count has reduced from a peak of 28.5 million during 1999 to 6.2 million today:

What is going on? Let’s take a closer look.

Introducing Colefax

“Lady Colefax began decorating in 1930. She was well-connected and also ahead of her time: her circle of friends and acquaintances provided her with clients and she became a very successful businesswoman.”

According to Colefax’s website, Lady (Sibyl) Colefax excelled at creating comfortable, stylish but “never pretentious” interiors for wealthy homeowners during the 1930s. By 1938 her business had become so popular that she recruited “rising young star” John Fowler to assist with the commissions.

Lady Colefax sold her business during 1948 and the subsequent decades witnessed various new owners that concluded with David Green during 1986. Mr Green broadened the group into fabric design through a handful of acquisitions during the late 1980s and late 1990s:

Sibyl Colefax & John Fowler Limited today remains an “ultra-luxury” interior-design subsidiary and continues to serve a “resolutely confidential” list of the rich and famous.

But approximately 90% of Colefax’s revenue and almost all profit is now earned through the sale of premium fabrics and wallpapers to other interior designers, with the United States the largest market followed by the UK and Europe.

Colefax’s website lists more than 7,000 different products, with the Acantha Navy fabric for example selling for £178 (inc. VAT) per metre…

… while the Arden Leaf Green wallpaper retails for £158 (inc. VAT) per roll:

Note that Colefax concentrates on the design of its fabrics and wallpapers, while all the manufacturing is outsourced to at least 120 high-end suppliers. The group claims this arrangement enables it to “respond rapidly to changing market tastes” and avoid the “complexity and capital intensive nature of manufacturing“. Sales are generated through a handful of trade showrooms, third-party agents on commission and exclusive distributors.

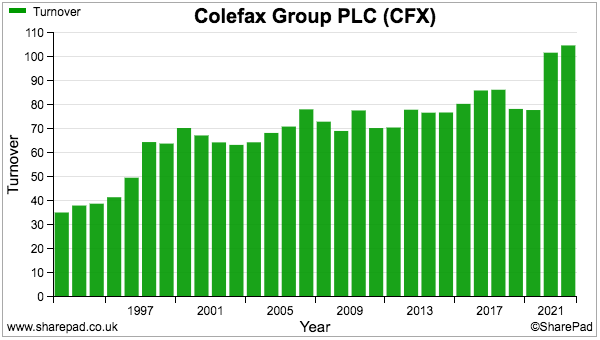

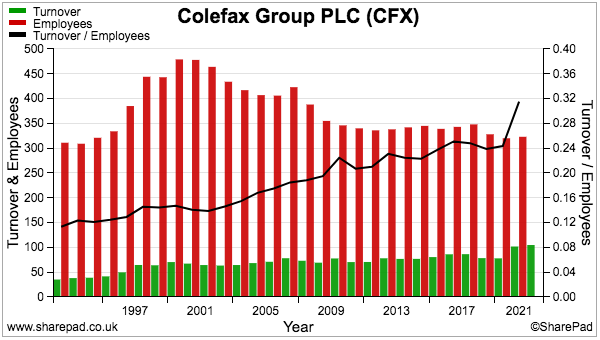

The business floated during 1988 at 125p and, until the last few years, had delivered a rather humdrum corporate history. Revenue for example had bobbed within the £70-80 million range for approximately 20 years:

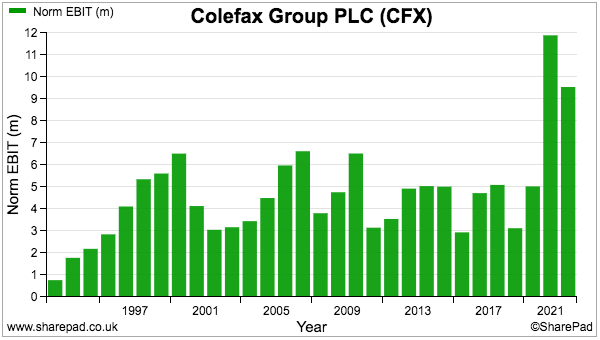

Operating profit meanwhile had rarely topped £6 million until it soared to £12 million during 2022:

The sudden financial improvement during the last few years was triggered by “very strong housing markets” following the Covid lockdowns. Affluent clients who moved home post-pandemic then spent heavily on new interior designs.

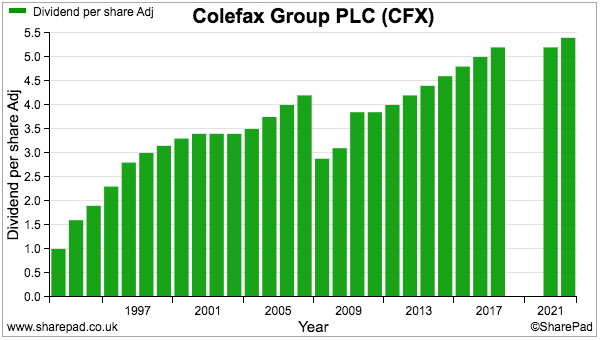

The dividend has shown a longer-term upward trend, albeit with setbacks occurring during the banking crash, when the payout was cut by 31%, and Covid, when the payout was scrapped entirely for two years:

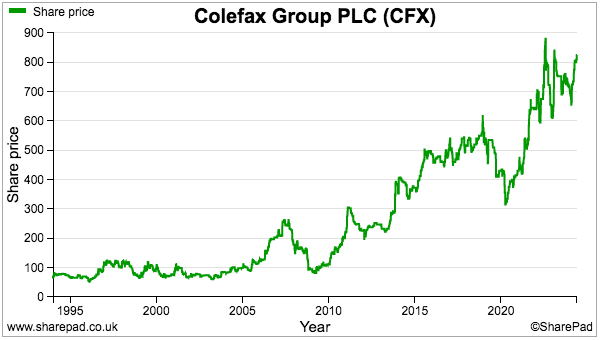

Given that Colefax is an extremely low-profile business with a generally modest growth rate, the share price has surprisingly been a creditable performer. Anyone picking up the shares at their 80p low during 2009 for example has since enjoyed a ten-bagger:

The present market cap at 825p is £51 million.

Buybacks

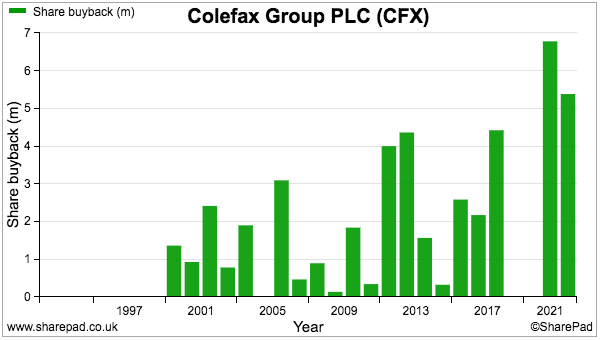

Colefax’s buybacks began in 1999 and the cumulative expenditure has since topped £50 million:

Among the buybacks were four tender offers that came to £20 million:

A fifth tender offer that occurred during the current financial year was undertaken at 700p per share and cost a further £7 million.

Colefax says it undertakes its larger buybacks through tender offers to “ensure that all shareholders are fairly treated and entitled to participate in direct proportion to their holdings“.

Buybacks (including tender offers) have gradually become a fundamental part of Colefax’s operations. The group gave this argument for buybacks during 2003:

“The rationale for share buybacks is to reduce the Group’s weighted average cost of capital, increase earnings per share and maximise return on capital employed.”

Then during 2009, Colefax upgraded its commentary to say the group was “committed” to buybacks:

“The Group Board remains committed to a strategy of share buybacks provided they enhance shareholder value through their effect on earnings per share, net assets per share and return on capital employed.”

And in 2021 the buybacks were upgraded again to a “policy” while also being deemed one of the group’s three core financial features:

“Since 1999 the Group has had a policy of returning surplus cash to shareholders through share buybacks… the Group is run in a relatively conservative manner with an emphasis on organic growth, cash generation and share buybacks.”

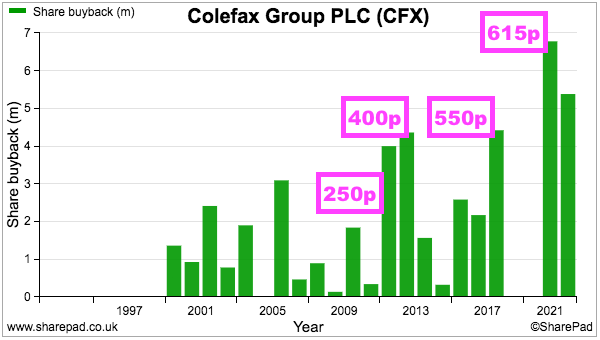

Whichever way the buybacks are described, they certainly look to have been very respectable purchases.

I calculate the buybacks conducted between 2001 and 2005 at between 66p and 95p have delivered compound annualised returns (excluding dividends) of approximately 12%.

Furthermore, the purchases undertaken during 2010 at 130p have since delivered a 14% annualised return (excluding dividends), with the 615p purchases of 2022 giving an annualised 15%.

Buybacks from other years have returned between 8% and 11% a year before dividends, which does not feel too bad for an obscure fabric designer which for the most part has delivered a very ordinary growth record.

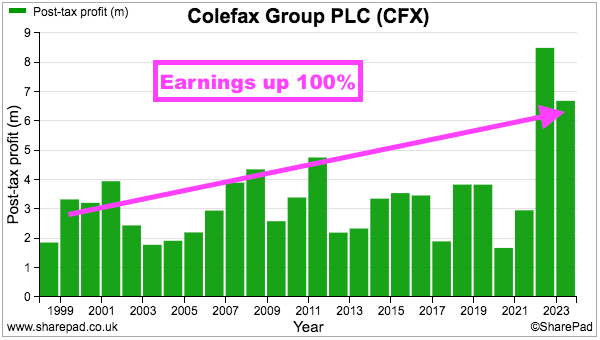

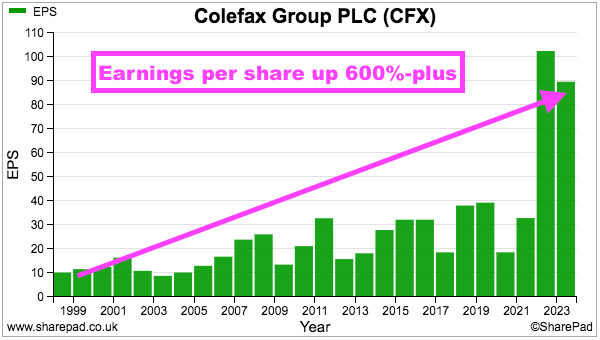

But following all the buybacks, the growth record on a per-share basis has not been so ordinary. While earnings have doubled to £6.7 million between 1999 and 2023…

… earnings per share have surged more than 600% to 90p:

Cash conversion, return on equity and profit margin

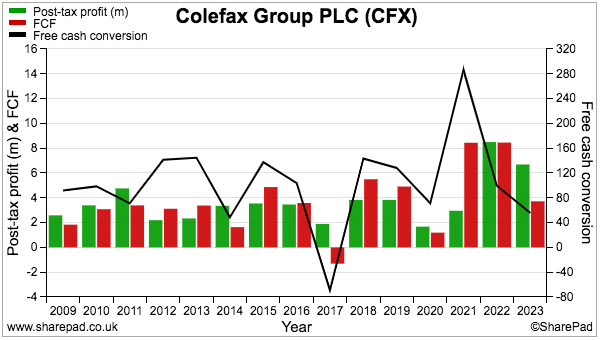

Colefax’s regular buybacks have been funded by impressive cash conversion:

Although the proportion of reported earnings translating into free cash has varied significantly from year to year, the conversion over multiple years can be more than 100%.

For example, SharePad indicates the last five years have witnessed aggregate earnings of £24 million turning into total free cash of £27 million. Over the last ten years, aggregate earnings of £40 million converted into total free cash of £41 million.

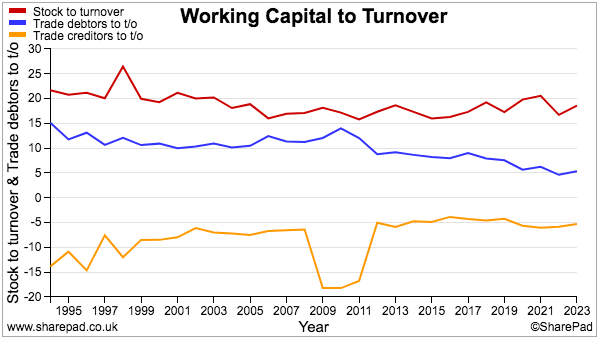

Commendable working capital management has supported the cash generation. In particular, the chart below shows both stocks (red line) and trade debtors (blue line) as proportions of revenue remaining remarkably steady during the last 30 years:

Note that stock levels at £19 million for 2023 were equivalent to a sizeable 19% of revenue, while stock expense of £26 million during the year, imply the fabrics and wallpapers sit in the warehouse for a lengthy nine months before being sold.

Colefax says high levels of stock are needed to ensure “outstanding” customer service for the demanding clientele, although the annual report does admit write-offs of obsolete fabrics and wallpapers typically exceed £1 million a year.

Free cash flow has also been supported by limited expenditure on property, plant and equipment and — very notably — an absence of acquisitions since the late 1990s.

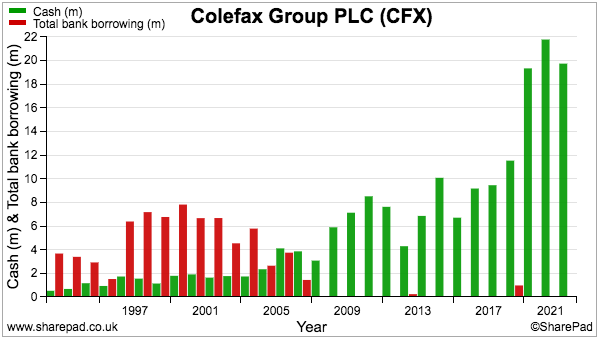

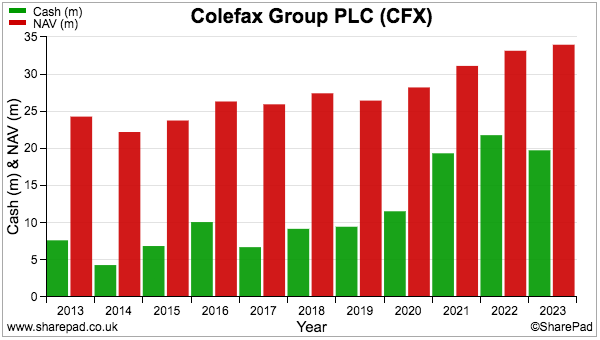

Despite the sizeable buybacks, the cash balance has piled higher while very little bank debt has been employed during the last 15 years:

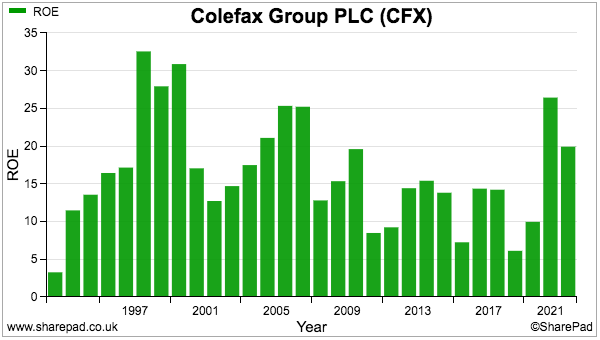

The substantial cash position will have influenced Colefax’s return on equity (ROE), which has fluctuated significantly and did indeed reach the 18% mentioned in that email I received:

Note that the last three years have witnessed cash of approximately £20 million that has represented about two-thirds of the group’s overall net asset value:

Strip out the cash position from the ROE sums, and the long-term returns on ‘operational’ equity could arguably have exceeded 20% and even surpassed 50% for 2023.

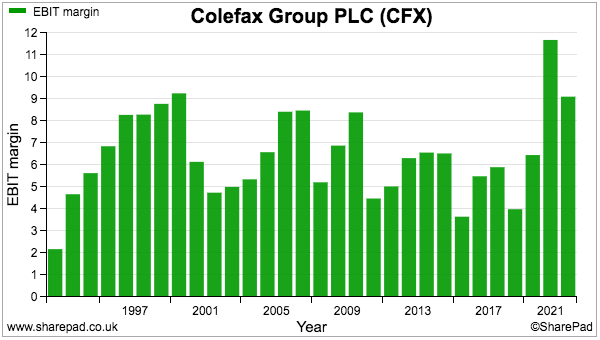

One measure that struggles to excite me is the single-digit operating margin:

The rich and famous appear savvy enough to buy luxury fabric and wallpaper at relatively keen prices.

Profitability among the group’s divisions appears to differ substantially. Companies House indicates the main UK subsidiary operated last year at a 4% margin, which suggests the rest of the group — mostly the Cowtan & Tout subsidiary in the States — enjoyed a more reasonable 14% margin.

Boardroom and corporate governance

The aforementioned David Green must be one of the longest serving bosses among quoted companies; he has served as Colefax’s chief executive since becoming the group’s largest shareholder during 1986. Mr Green took on the additional role of chairman from 1996.

Mr Green looks to have deliberately avoided the limelight during his tenure at Colefax — online searches yield very little about him or his earlier career.

But during the early 1980s, Mr Green and his younger brother Michael did establish Carlton Communications — which eventually became a significant part of ITV. Mr Green seemingly preferred interior design to commercial television.

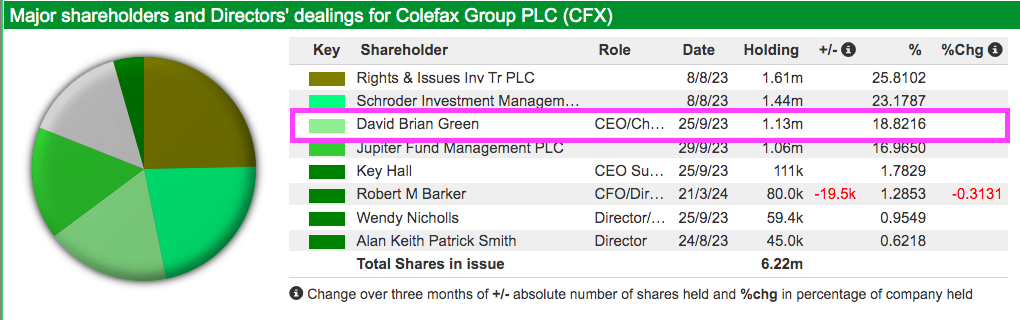

Mr Green is clearly the architect of the buyback policy and has created greater wealth for both himself as well as outside shareholders. He presently boasts an 18%/£9 million shareholding:

For years Mr Green owned more than 4 million shares, but participation in the tender offers alongside share transfers to family members have since reduced his shareholding by more than 70%:

Mr Green is 78 years old and his lighter shareholding presumably reflects ongoing retirement planning.

Nonetheless, his shareholding currently pays him a £621k annual dividend that is a fraction higher than his (useful) £610k salary. I would therefore hope Mr Green still has the ‘owners’s eye’ on proceedings.

Mr Green performing the roles of both chief executive and chairman is one of a number of ‘quirks’ within Colefax’s boardroom.

The appointment of only one non-exec means chief executive Mr Green, sits on the remuneration committee while the finance director sits on the audit committee — which are both corporate-governance no-nos.

Colefax claims the sole non-exec is ‘independent’ for corporate-governance purposes, although the non-exec is 83 years old, has served on the board since 1994 and, according to Companies House, resides in the same cul-de-sac as Mr Green.

The rest of the board comprises the finance director and two other executives, all of whom have been board fixtures since at least 2000.

The board has in fact consisted of the same five directors for the last 20 years. The absence of change may be due to Colefax restricting board re-elections to only one director a year, which is definitely not best practice. Mr Green’s next re-election looks set for 2025.

Colefax’s board structure may not be to everyone’s taste, but arguably the set-up has ensured a very positive effect on workforce productivity. Revenue per employee has steadily improved and recently surpassed a very impressive £300,000:

Forecasts and verdict

Half-year results published during January were not great and reflected the “impact of high interest rates and lower levels of housing market activity.”

H1 sales remained flat at £52 million but H1 profit fell 16% to less than £5 million following “high levels of cost inflation“. The immediate outlook was not encouraging:

“We are therefore expecting conditions to become more difficult… and we believe trading conditions are likely to remain challenging for much of the next financial year.”

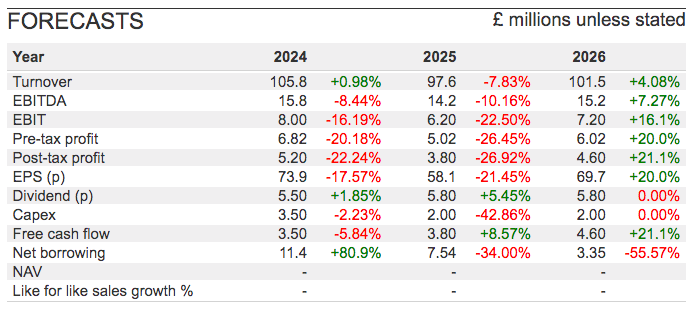

Brokers have translated the downbeat narrative into the following projections:

The gloomy forecasts running into 2025 are an obvious drawback, and perhaps the sudden 2026 profit recovery may prove to be somewhat optimistic.

Still, dividend payments are not expected to be trimmed and dividend cover — at more than 10 times! — does imply Colefax wishes to retain substantial sums for buybacks…

…which I would venture will continue to be the primary support for long-term returns.

Adjust for what is now a £17 million (or 275p per share) net cash position and maybe the 825p shares trade at less than 10 times the depressed 58p per share earnings anticipated for 2025.

The latest tender offer was priced at 700p, which on the same cash-adjusted basis would lead to a 7x multiple on the same 2025 forecast.

To answer the intriguing email, what do I think?

While the shares do not appear expensive given the impressive cash generation and positive buyback history, I believe Colefax’s small size, low profile and awkward corporate governance could always keep a lid on the share-price rating.

For fans of luxury fabrics, obscure small-caps, Mr Green and/or buybacks in general, purchasing at the last 700p buyback level would at least provide some comfort from Mr Green also believing such a buy-price made sense.

Longer term, I can’t imagine Mr Green allowing his 18% shareholding to wither and perhaps the buybacks will cease only when Mr Green wishes to finally retire — and he persuades a generous bidder to purchase every Colefax share!

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Colefax.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.